Mat On Sez In India

100 income tax exemption on export income for sez units under section 10aa of the income tax act for first 5 years 50 for next 5 years thereafter and 50 of the ploughed back export profit for next 5 years.

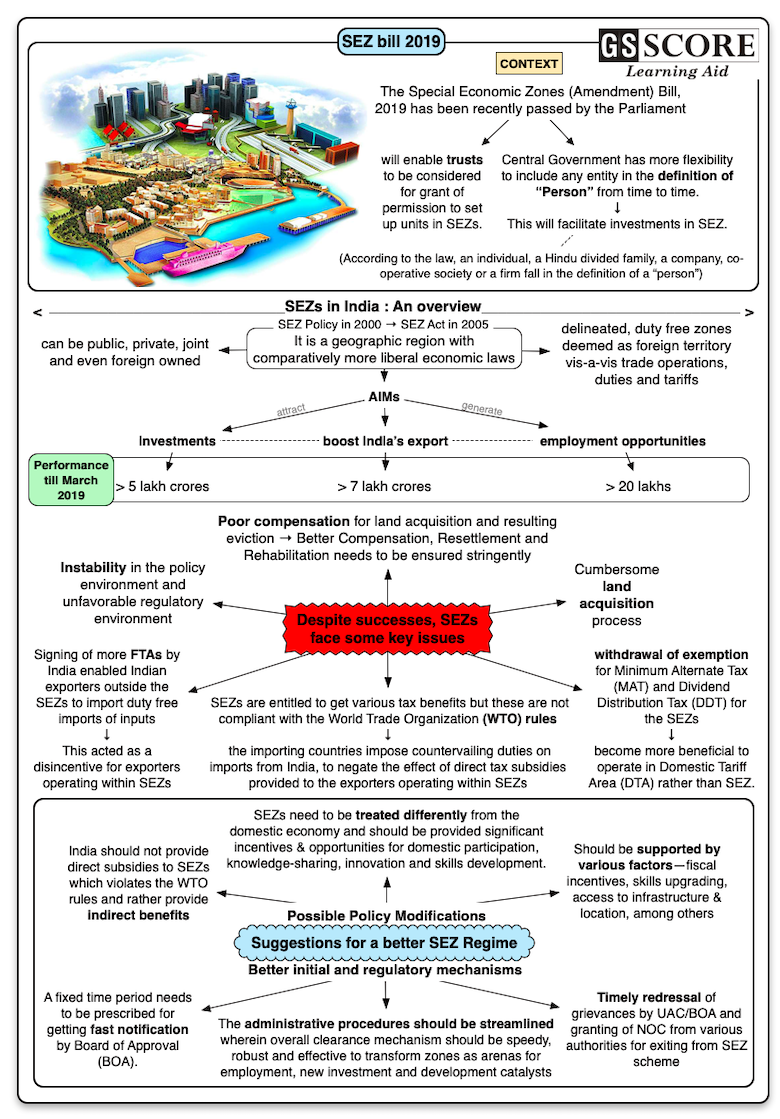

Mat on sez in india. Minimum alternate tax mat is a tax effectively introduced in india by the finance act of 1987 vide section 115j of the income tax act 1961 it act to facilitate the taxation of zero tax companies i e those companies which show zero or negligible income to avoid tax. Ideally mat should not be levied on sez units as it s against the very concept of providing tax concession to the industry to promote investment and exports from india said vikas vasal partner grant thornton india llp. At the same time momentum with sez is declining as several units have came out of the facility because of declined tax benefit. Mat is a tax provision reintroduced in 1997 in an attempt to bring zero tax high profits companies into the income tax net.

As part of the budget on february 29 a reduced minimum alternate tax mat rate of nine per cent was proposed for the ifsc in an sez in gujarat while retaining 18 5 per cent mat on all other sez. There is a credit of mat of 4 68 000 which can be carried forward to 15 assessment year. The sez policy was unveiled by the nda government in 2000. Hence tax payable by company 20 28 000.

The budget also announced. Total tax payable under mat 19 50 000 78 800 20 28 000. There is some controversy on whether a company opting for the lower tax regime would lose the mat credits which it may have accumulated in the past said hitesh gajaria partner and co head of tax kpmg india. It is calculated on the basis of the book profits of a company not its.

The provisions of minimum alternate tax mat have been made applicable to special economic zone sez developers and units with effect from 1st april 2012 and the exemption of dividend distribution tax ddt in the case of sez developers under the income tax act for dividends declared distributed or paid is not available after 1st june 2011. Though the sez units enjoy income tax exemption in a sunset manner they have to pay the mat rate. Sunset clause for units will become effective from 01 04 2020.