Mat Credit Utilisation

4 relevant extract of the budget speech 1996 97.

Mat credit utilisation. The amount of mat credit can be set off only in the year. 1 lakh the tax liability as per the normal provisions for fy 2019 20 is rs. This is being done so that the chances of falling under regular corporate taxes are increased and accumulated. The mat credit is available in respect of mat paid under section 115jb of the income tax act 1961 with effect from asst.

A tax credit scheme is introduced by which mat paid can be carried forward for set off against regular tax payable during the subsequent fifteen years period subject to certain conditions as under. Mat liability excluding cess and surcharge 15 on rs 18 40 000 will come to rs. Rs 14 43 000 rs 12 48 000 rs 1 95 000. I propose to introduce a minimum alternate tax mat on companies.

In a case where the total income of the company. The amount of mat credit can be set off only in the year in which the company is liable to pay tax as per the normal provisions of the act and such tax. Further whether mat credit is to be utilised in immediate previous year in which tax amt as per other provision exceeds the mat or it is optional for the assessee to choose the previous year in next 10 years for utilisation of credit. Mat credit under section 115jaa.

Such tax credit shall be carried forward for 15 assessment years immediately succeeding the assessment year in which such credit has become allowable. 8 52 000 plus cess as applicable being higher than the mat liability. 10 lakh while that as per the. A domestic company is taxable at the rate of 25 if its turnover or gross receipt does.

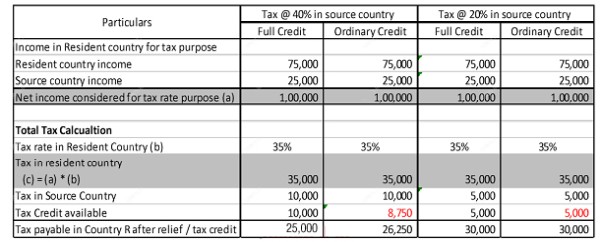

Thus the tax liability of sm energy pvt. The maximum amount of mat credit that you can claim cannot exceed the difference between the normal tax liability and the mat liability in the year for which the mat credit is being availed. The mat credit so determined can be carried forward for set off for five succeeding years from the year in which mat credit becomes allowable proposed amendment in finance act 2006 7 years. The amount of mat credit would be equal to the excess of mat over normal income tax liability for which mat is paid during the said assessment year.

If a company has mat credit of rs. For example companies have started molding their accounting policies to post lower net profits. In the race of utilization of mat credit to gain the benefit of the set off several adverse consequences are taken on by the companies. However if mat credit cannot be utilised by the company within a period of 15 years immediately succeeding the assessment year in which such credit was generated then it will lapse.