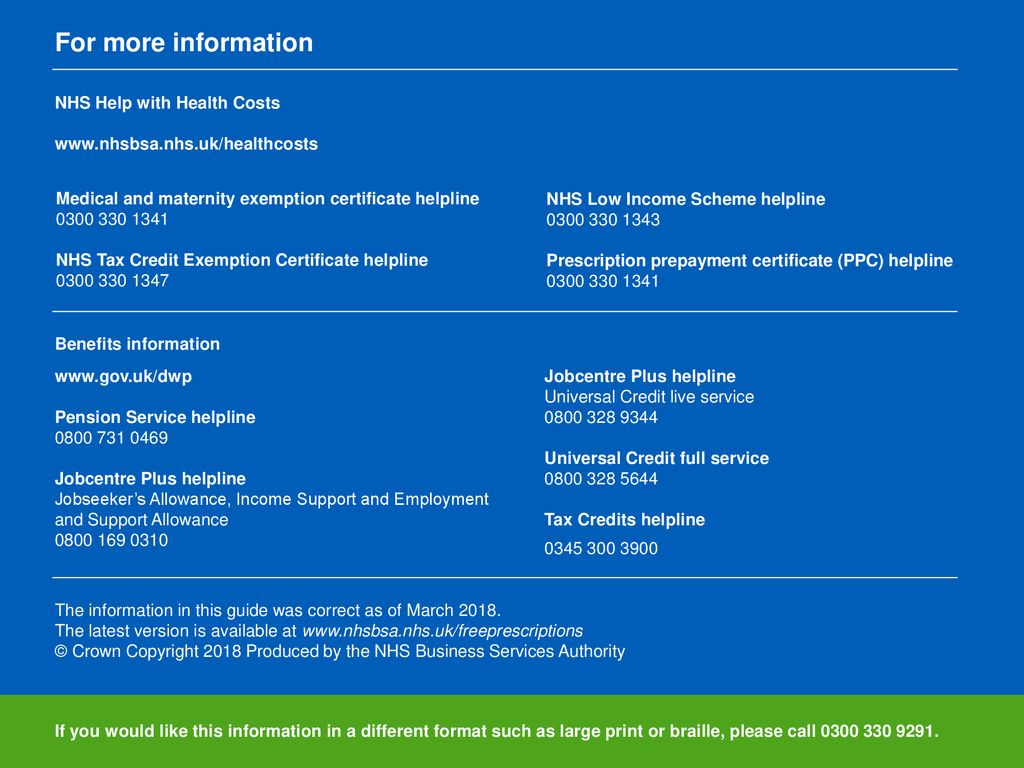

Mat Allowance Helpline

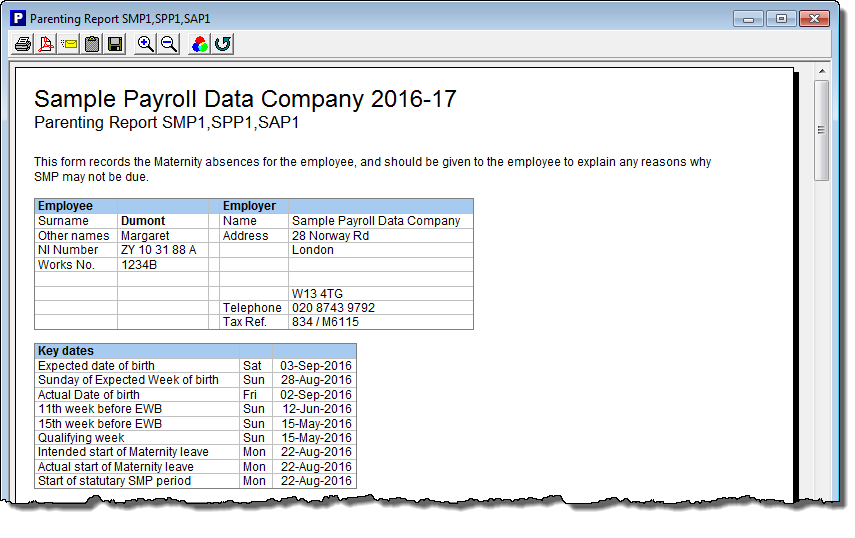

Mat allowance you must work ie pay national insurance 26 weeks out of a 66 week period before your baby is due and earn at least 30 a week average.

Mat allowance helpline. Mat maternity allowance threshold. Minimum level of earnings to qualify for ma ma test period the period of 66 weeks immediately preceding the week in which your baby is due. The maternity benefit due to the member would be p21 000 350 00 x 60 in case of normal delivery miscarriage and p27 300 350 00 x 78 in case of cesarean delivery. This page contains information on key maternity rightsstatutory maternity pay smp maternity allowance ma maternity allowance if you are self employedemployment and support allowance maternity frequently asked questions about maternity payoccupational maternity paybenefits for familieswhere to go for more helpmore maternity action information sheets april 2020 this information sheet outlines.

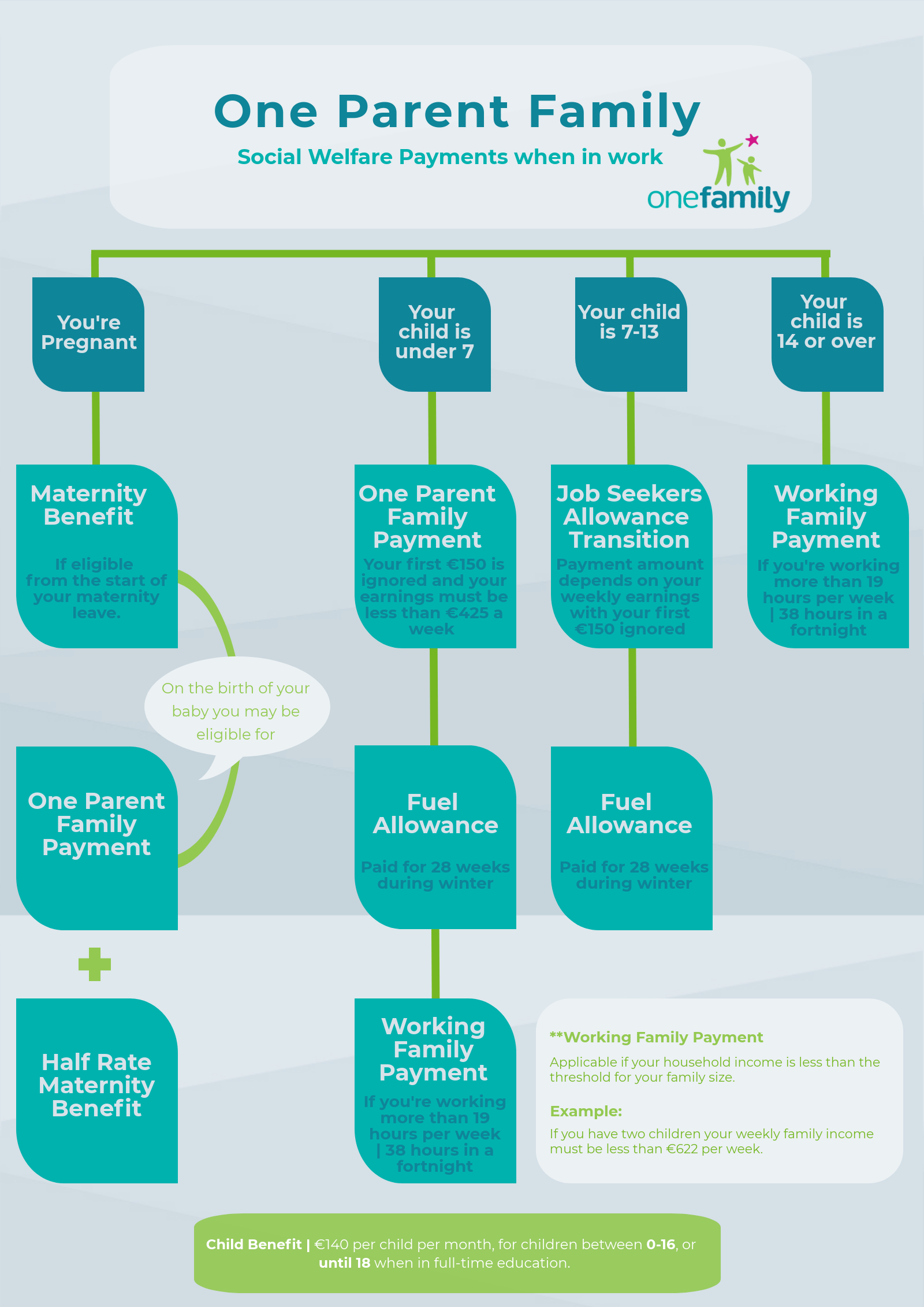

Maternity allowance is paid to pregnant women who do not get statutory maternity pay rate eligibility apply form ma1. Maternity allowance is paid to pregnant women who do not get statutory maternity pay rate eligibility apply form ma1. Maternity allowance can be a valuable boost to your income if you re self employed and take time off to have a baby. Any part week counts as one for the 26.

Maternity allowance if you re self employed. The daily maternity allowance would be 350 00 63 000 180. In case the member died on august 31 1998 the maternity benefit due is p10 500 350 00 x 30 i e. It s an employee helpline of sorts and i ve known people call them in the past and they ve said good things.

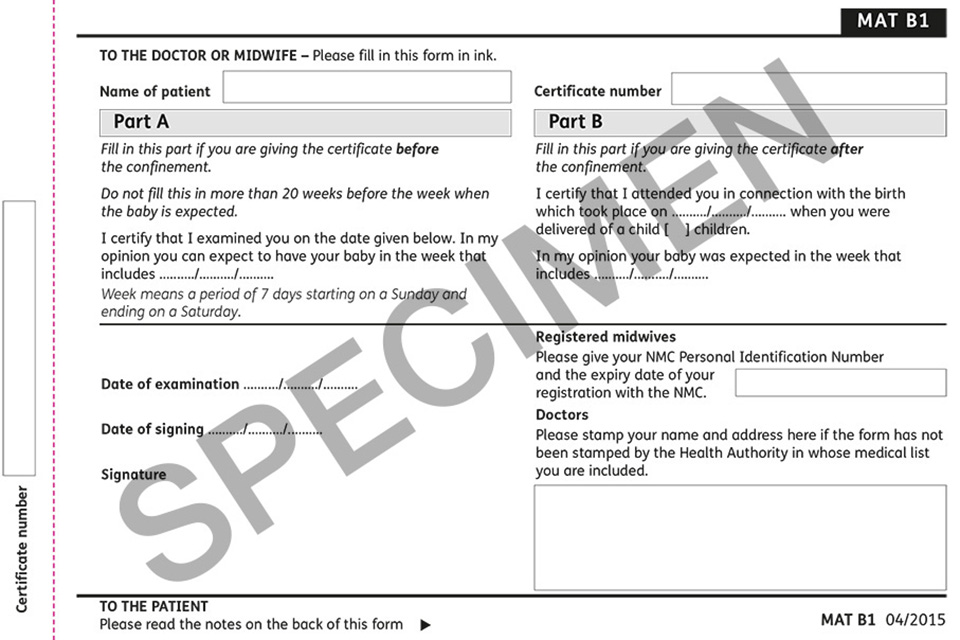

Yes i started my current job when i was 12 weeks pregnant and am able to claim mat allowance from the government. You ll need an smp1 form from your employer to send off with your mat allowance application. Also remember to get your matb1 form off them too as you ll need the original copy. 4 may 2016 replaced all 3 versions with march 2016 editions.