Mat Rate For Ay 2012 13

How is mat calculated.

Mat rate for ay 2012 13. Ay 2014 15 fy 2013 14. If distributed to individual huf. 2012 13 2011 12 2010 2011 tags. Charges other than brokerage for stock exchange transactions january 20 2013.

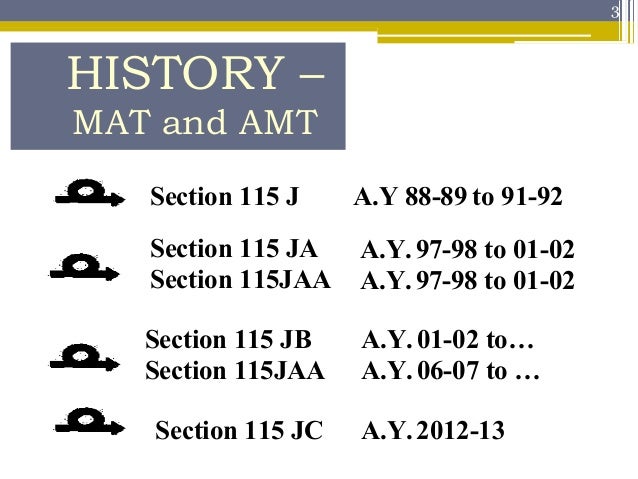

If distributed to any other person. Mat is calculated at 15 of the book profit as per section 115jb of income tax act 1961. No option left for the corporates. The above difference for set off of mat credit has been reduced to 13 03 from 30 25 in ay 2001 02.

Ay 2013 14 fy 2012 13 be the first to comment leave a reply cancel reply. If distributed to individual huf. 8 40 000 will amount to rs. Download income tax calculator for a y.

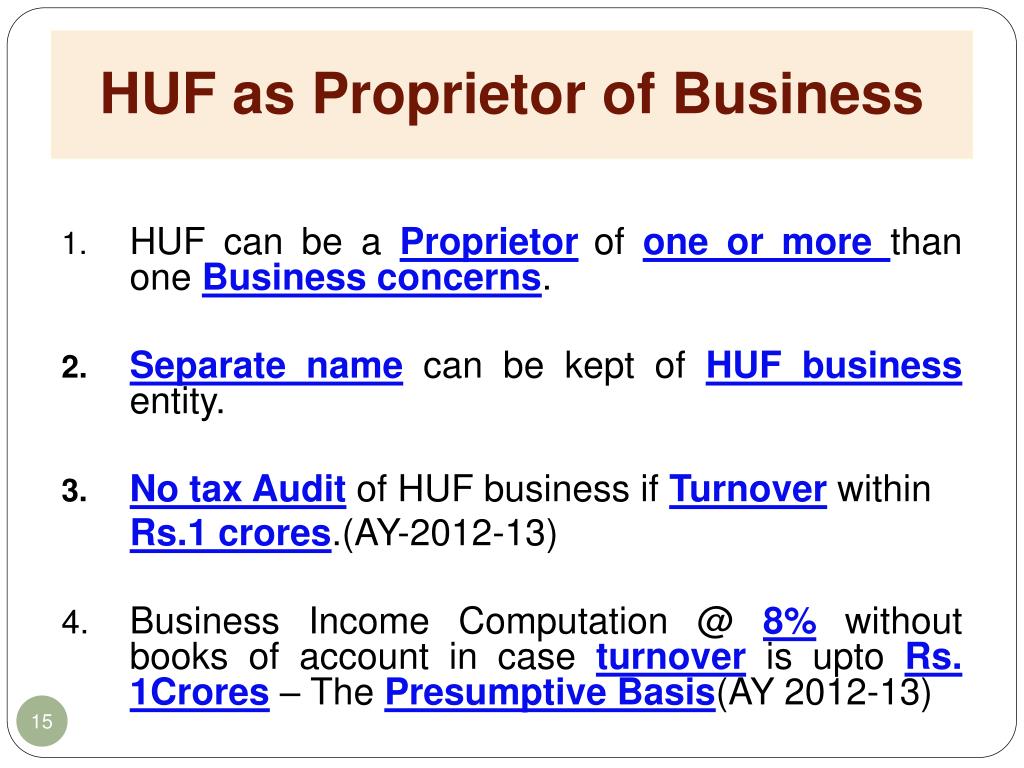

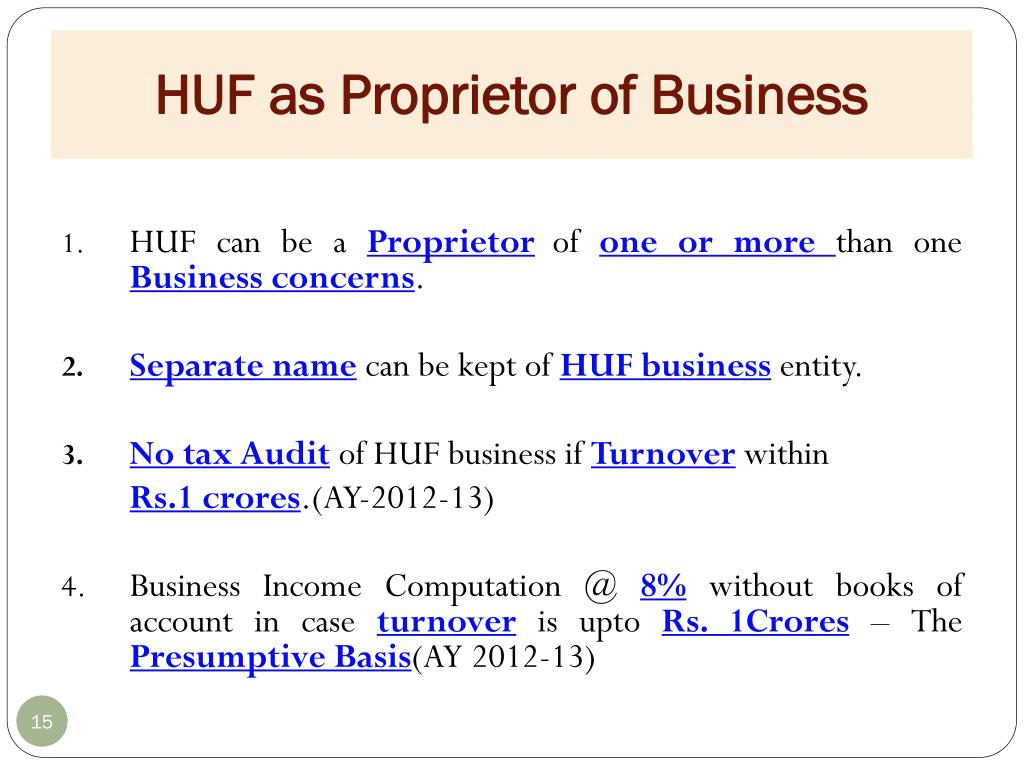

I normal tax liability or ii mat. Tax 30 on rs. 1 1 for individuals hindu undivided families association of persons and body of individuals. Income tax rates income tax slabs for ay 2012 13 individuals and hufs.

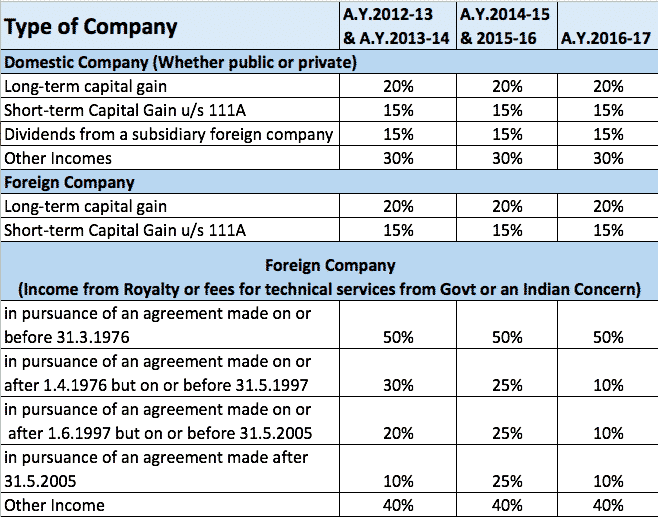

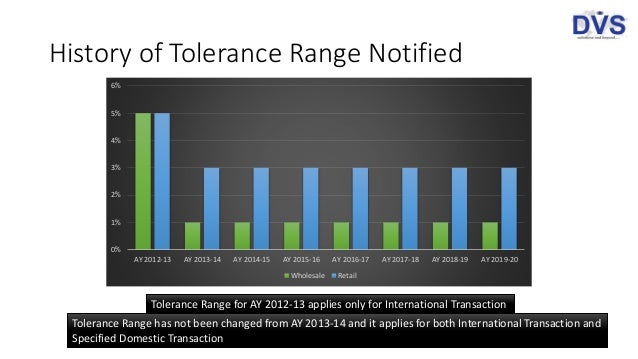

Check your demat account holding statement december 25 2012. Tax rates are for assessment year 2012 13 assessment year 2011 12 assessment year 2010 11 ay 2009 10 basic rates for companies are same however surcharge has been reduced to 5 from 10 dividend distribution tax rate are same in last four years mat minimum alternate tax rate has been increased in last four years. Money market mutual funds or liquid funds a y. The rates are for the previous year 2012 13.

The present mat rate as of fy 2019 20 is 15 of book profit previously 18 5 plus applicable cess and surcharge. The tax liability of a company will be higher of. Thus corporates were given higher mat credit when tax liability under mat was very low and reduced the same when rate under mat increased to very high rate of 18 5. Tax rates are for assessment year 2012 13 assessment year 2011 12 assessment year 2010 11 ay 2009 10 basic rates for companies are same however surcharge has been reduced to 5 from 10 dividend distribution tax rate are same in last four years mat minimum alternate tax rate has been increased in last four years.

If distributed to any other person. Funds other than money market funds or liquid funds. In case of individual other than ii iii and iv below and huf s no income level slabs income tax rate. Where the total income does not exceed rs.

All companies are required to pay corporate tax based on which is higher of the following. Normal tax rate applicable to an indian company is 30 plus cess and surcharge as applicable.