Monte Carlo Simulation Matlab Example

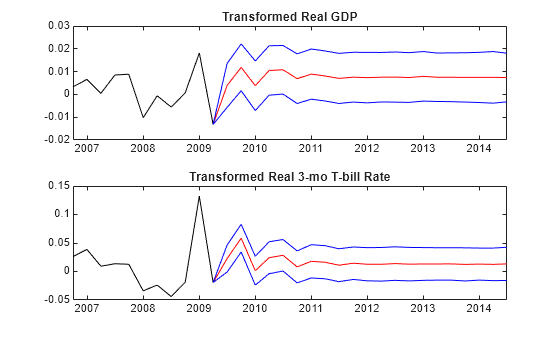

This example shows how prices for financial options can be calculated on a gpu using monte carlo methods.

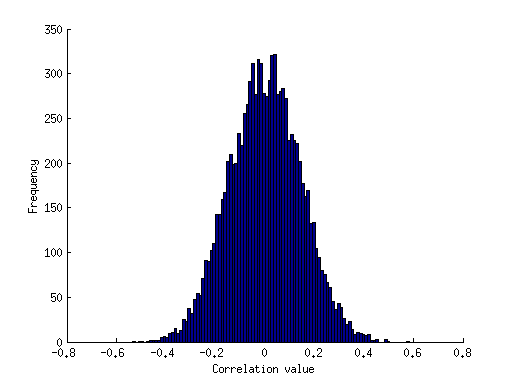

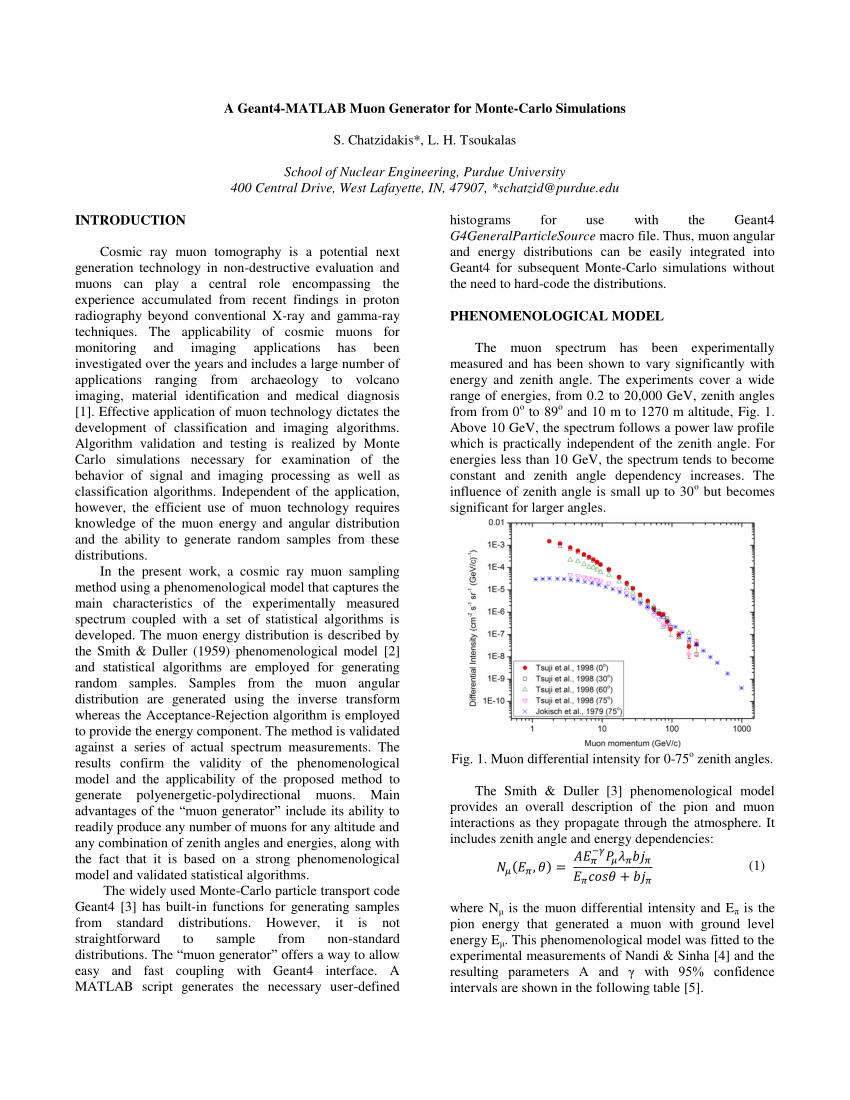

Monte carlo simulation matlab example. Monte carlo simulations are named after the popular gambling destination in monaco since chance and random outcomes are central to the modeling technique much as. Monte carlo simulation was named after the city in monaco famous for its casino where games of chance e g roulette involve repetitive events with known probabilities. The method finds all possible outcomes of your decisions and assesses the impact of risk. It is used to model the probability of various outcomes in a project or process that cannot easily be estimated because of the intervention of random variables.

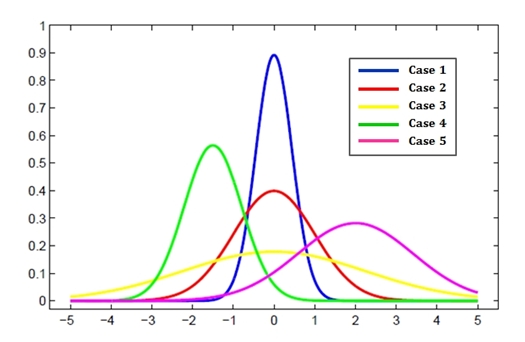

Matlab is used for financial modeling weather forecasting operations analysis and many other applications. For example the following monte carlo method calculates the value of π. The matlab language provides a variety of high level mathematical functions you can use to build a model for monte carlo simulation and to run those simulations. This example is a function so that the helpers can be nested inside it.

The monte carlo simulation is a quantitative risk analysis technique which is used to understand the impact of risk and uncertainty in project management. Uniformly scatter some points over a unit square 0 1 0 1 as in figure. Although there were a number of isolated and undeveloped applications of monte carlo simulation principles at earlier dates modern application of monte carlo methods date. Monte carlo simulation also called the monte carlo method or monte carlo sampling is a way to account for risk in decision making and quantitative analysis.

Monte carlo simulation history. I would like to perform a monte carlo simulation in matlab and would like to see an example for this. Three simple types of exotic option are used as examples but more complex options can be priced in a similar way.