Minimum Alternate Tax Mat On Fiis

This rs 40 000 crore demand is a tax pertaining to years before finance minister arun jaitley announced scrapping of mat.

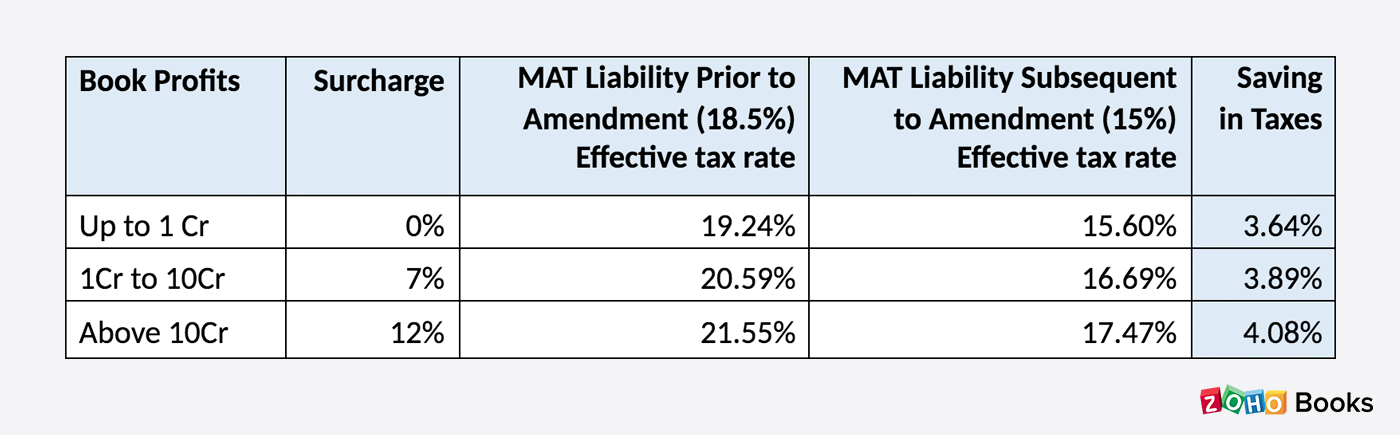

Minimum alternate tax mat on fiis. In india mat is levied under section 115jb of the income tax act 1961. Payable tax cannot be less than the 18 5 of book profit in an assessment year the mat rate has been reduced to 15 from fy 19 20. The much awaited ap shah panel report on levy of minimum alternate tax mat on foreign institutional investors has not recommended any relief to fiis. With mat companies have to pay up a minimum amount of tax to the government.

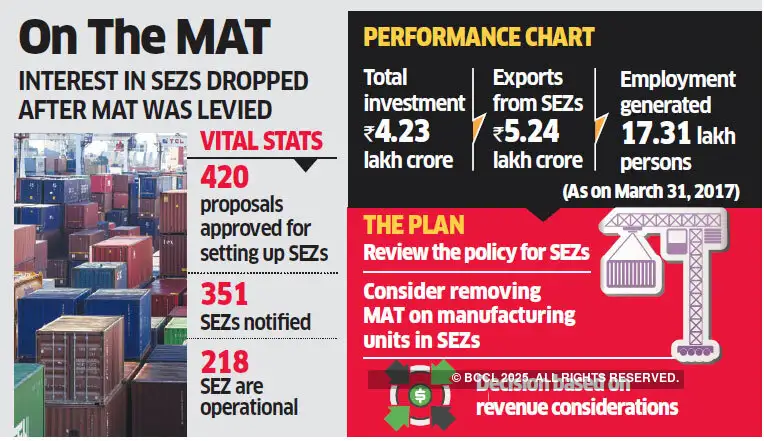

602 83 crore for previous years. No minimum alternate tax to be levied on fiis fpis prior to 1 april 2015 the applicability of minimum alternate tax mat to foreign companies in india has historically been a complex issue. There are specific provisions under the income tax act 1961 under which the mat is collected from every company it is calculated under section 115jb of the income tax act. What is this mat issue pertaining to fiis then.

No one was expecting this tax demand as the new government had clearly stated that minimum alternate tax mat will be abolished from april 1 2015. It was introduced in the year 1987 and. In 1987 prime minister rajiv gandhi in charge of the finance portfolio introduced what he called a minimum corporate tax to target corporates including reliance which was then an undivided group that made profits and paid dividends to shareholders but paid very little. Essentially mat is taxation on the book profits of a company although under the income tax act 1961 ita no tax would be payable because of tax.

The income tax department has slapped notices on 68 fiis demanding mat dues of rs. What is minimum alternate tax the massive demand that the i t department has slapped on fiis and fpis. Cbdt to expeditiously process mat exemption claims of fiis. Therefore even for the applicability if applicable at all of mat on fiis fpis being a company the existence of pe is necessary.

For calculating the tax outflow of company first the tax is required to be calculated. Government on friday said the tax department will expeditiously process the cases where fiis have claimed exemption from minimum alternate tax mat as a benefit under the bilateral tax treaties.