Mat Rate For Ay 2013 14

For individuals males and females both below the age of 60 years hufs aops bols income tax rates tax slabs ay 2018 2019 2019 2020.

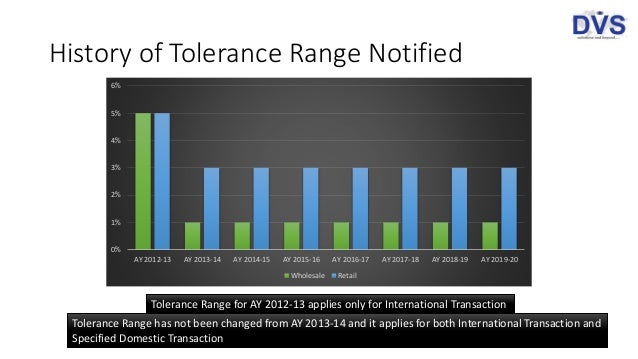

Mat rate for ay 2013 14. The above difference for set off of mat credit has been reduced to 13 03. Tax rates are for assessment year 2012 13 assessment year 2011 12 assessment year 2010 11 ay 2009 10 basic rates for companies are same however surcharge has been reduced to 5 from 10 dividend distribution tax rate are same in last four years mat minimum alternate tax rate has been increased in last four years. In each finance bill the government increased the rate of mat and now this rate has increased to 18 5 in ay 2013 14 from 7 5 in ay 2001 02 and simultaneously kept reducing the difference between the mat and normal rate to reduce the eligibility of mat to the companies. Income tax rates for fy 2013 14 ay 2014 15.

Minor changes has been made in tds rates for fy 2013 14 by finance minister in budget. New rates comes in to effect from this financial year i e. Tax computed in above manner can be termed as normal tax. 2014 15 ay means 1013 14 fy.

A new section 194 ia has been added wef 01 06 2013 to deduct tax on transfer of property other than agriculture land 1. In the budget 2013 announcement the tax slabs has been broadened for men and senior citizens by the indian finance ministry. One who can use itr 1 can use itr 2 also. Both can be used.

We have provided the tax deduction rates chart tds rate chart for financial year 2013 14. Income tax rates tax slabs ay 2014 2015 2015 2016. Research by deloitte has shown that the lesser the difference between the corporate rates of taxation and mat rates the more probable it is for companies to fall within the latter and continue to fall within the same this is arguably because a higher mat rate levied on much higher book profits would in most cases be greater than a corporate tax rate higher than mat rate by a constantly. As per the concept of mat the tax liability of a company will be higher of the following.

Tax liability of the company computed as per the normal provisions of the income tax law i e tax computed on the taxable income of the company by applying the tax rate applicable to the company. 2014 15 fy or 2015 16 ay.