Mat Rate For Ay 2010 11

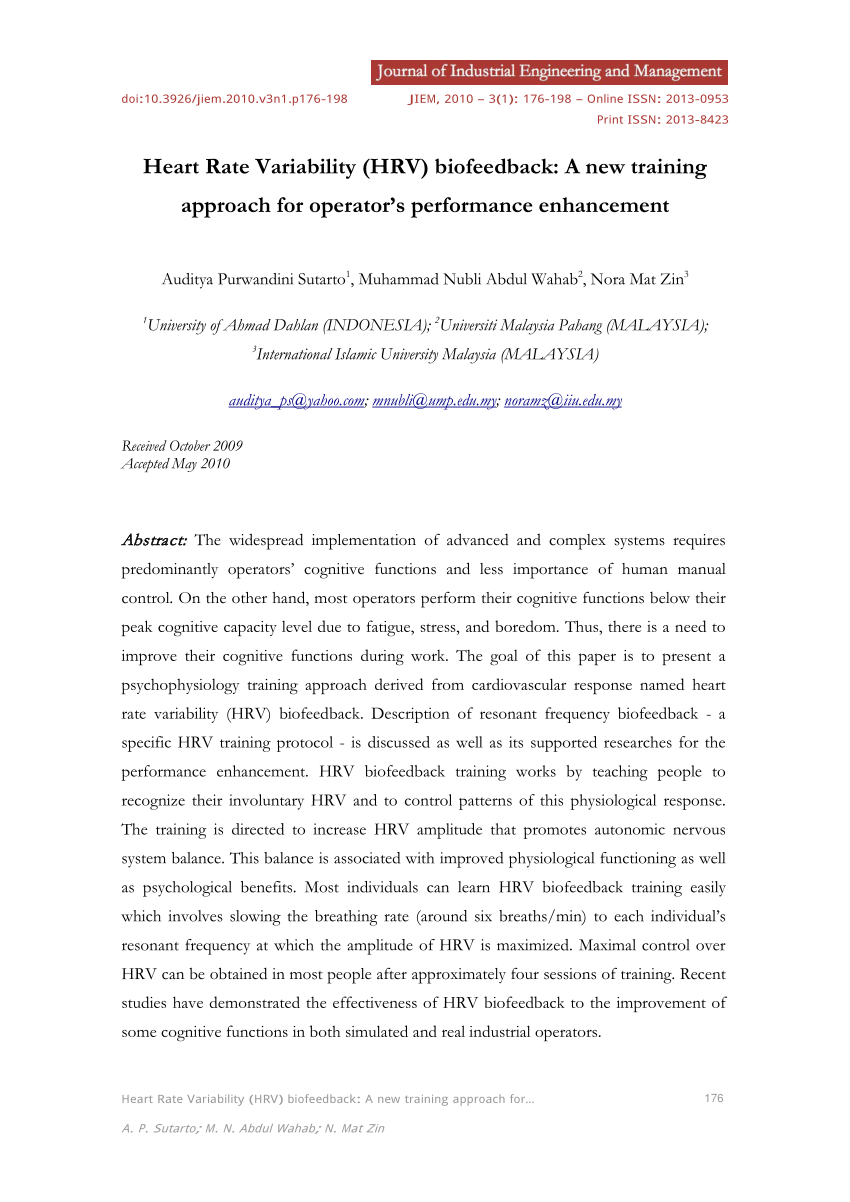

Thus corporates were given higher mat credit when tax liability under mat was very low and reduced the same when rate under mat increased to very high rate of 18 5.

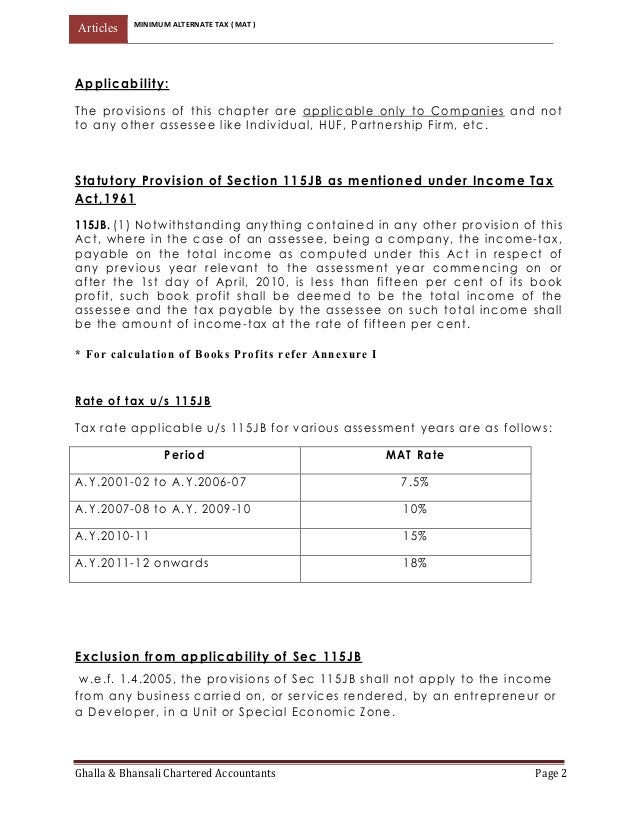

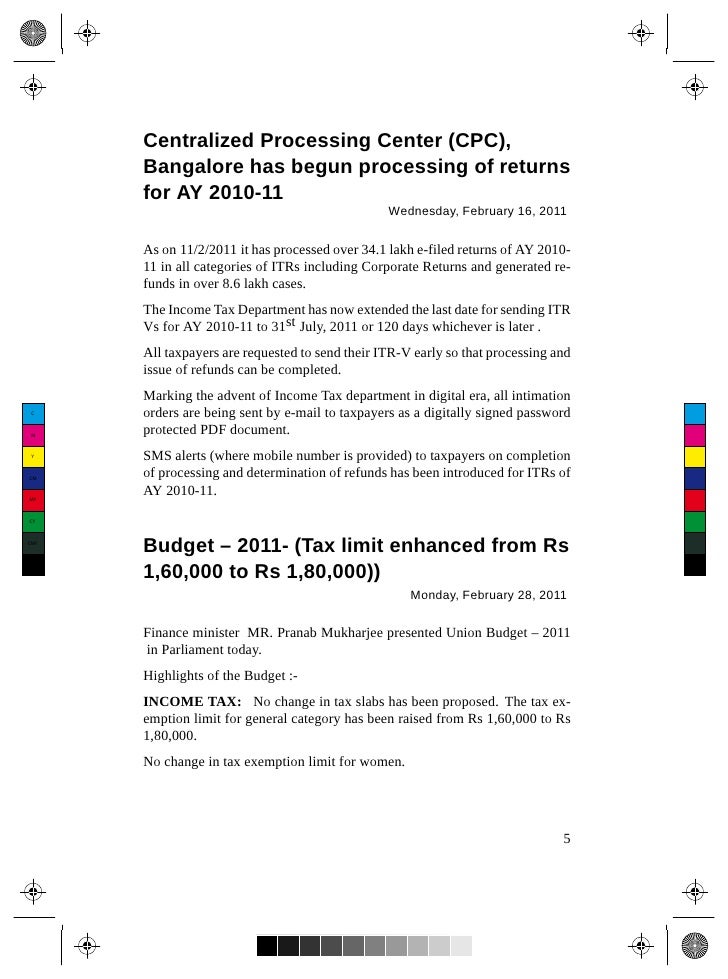

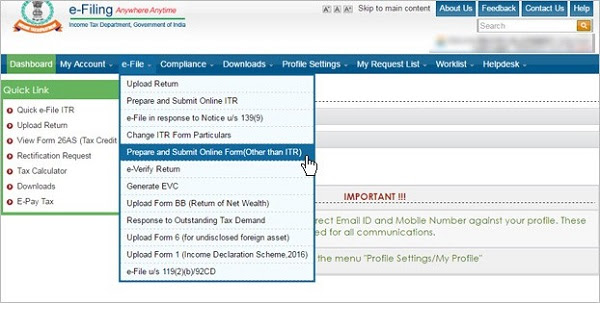

Mat rate for ay 2010 11. No surcharge will be levied on companies having total income of not more than rs. Tax paid under section 115jb for a y. Applicable for ay 2010 11 fy 2009 10 minimum alternate tax. Mat rates and regular tax rates for companies 10 mat credit and carry forward mechanism for companies 12.

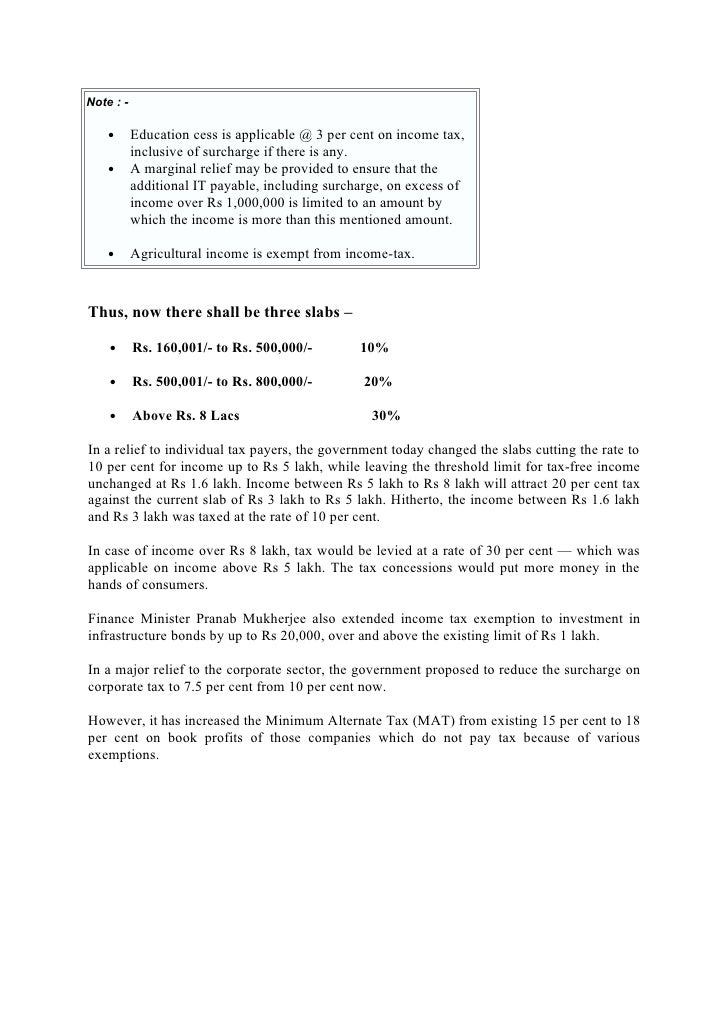

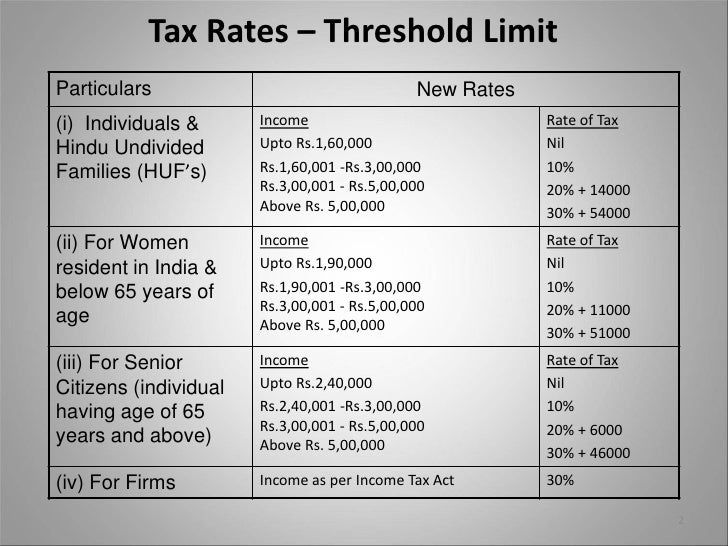

Income tax rates slab for assesment year rate 2011 12 f y 2010 11 up to 1 60 000 up to 1 90 000 for women nil up to 2 40 000 for resident individual of 65 years or above 1 60 001 5 00 000 10 5 00 001 8 00 000 20 8 00 001 upwards 30 few amendments made to the. Special rates long term capital gains. For individuals huf association of persons aop and body of individuals boi. In ay 2019 20 minimum alternate tax mat will be levied 18 5 on book profit.

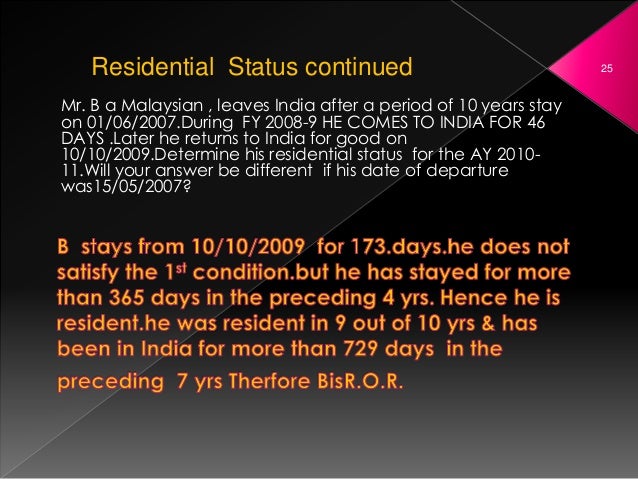

1 lakh the tax liability as per the normal provisions for fy 2019 20 is rs. Income tax slabs fy 2010 11 1. As per the taxation laws amendment bill 2019 the amended slab rates for companies are as under. Income tax rates slabs ay 2010 11 individual huf boi aop the rates for assessment year 2010 11 is given in the table below these rates are applicable on individual assessee hindu undivided family hufs association of persons aop and body of individuals boi.

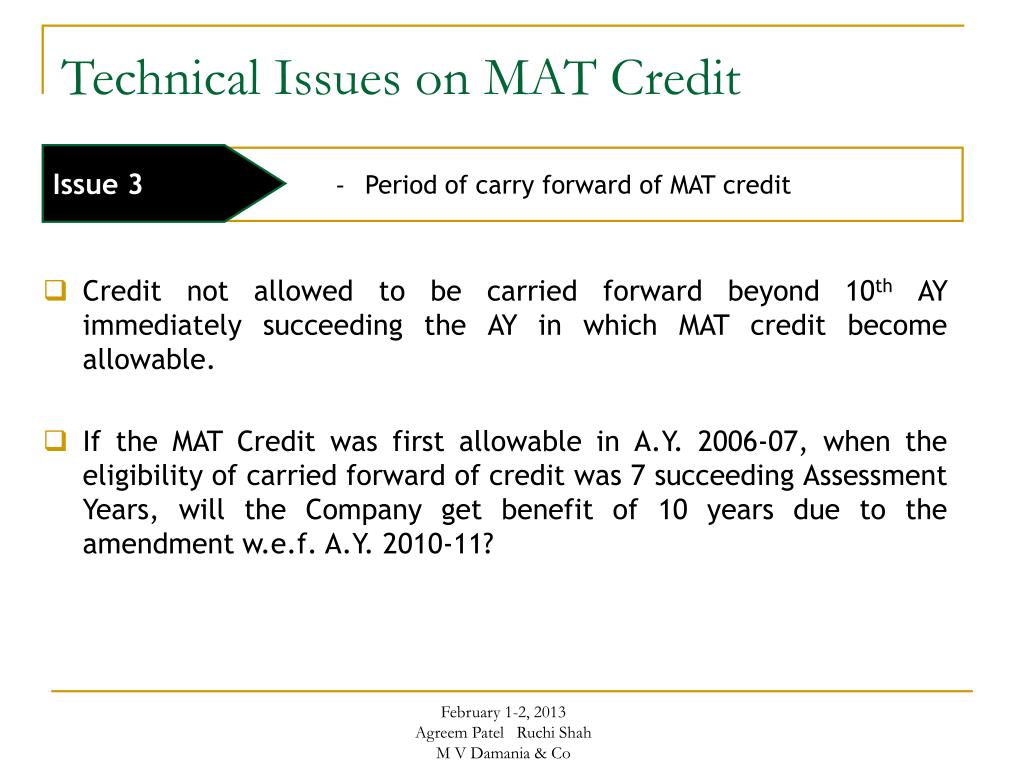

The above difference for set off of mat credit has been reduced to 13 03 from 30 25 in ay 2001 02. Mat credit available in respect of mat paid from a y. Applicable for ay 2010 11 fy 2009 10 mat credit is permitted up to 10 years from current 7. For provisions relating to amt refer tutorial on mat amt in tutorial section.

Mat credit to be carried forward for set off for. Companies have to pay mat u s 115jb at the rate of 10. If a company has mat credit of rs. A for all existing domestic companies as per section 115ba.

This rate has been revised to 15. Ii corporate tax rate applicable for ay 2020 21. No option left for the corporates. 2006 07 and any subsequent year would be allowed as a credit from the normal tax payable for any subsequent year in accordance with the provisions contained in section 115jaa for 7 assessment years upto assessment year 2009 10 and for 10 assessment years from assessment year 2010 11.

Assessment year 2019 20 in case of a unit located in an ifsc which derives its income solely in convertible foreign exchange the rate of amt under section 115jf shall be at the rate of 9 instead of existing rate of 18 50. The maximum amount of mat credit that you can claim cannot exceed the difference between the normal tax liability and the mat liability in the year for which the mat credit is being availed.