Mat On Capital Receipt

It is axiomatic that no tax shall be levied or collected except by the authority of law.

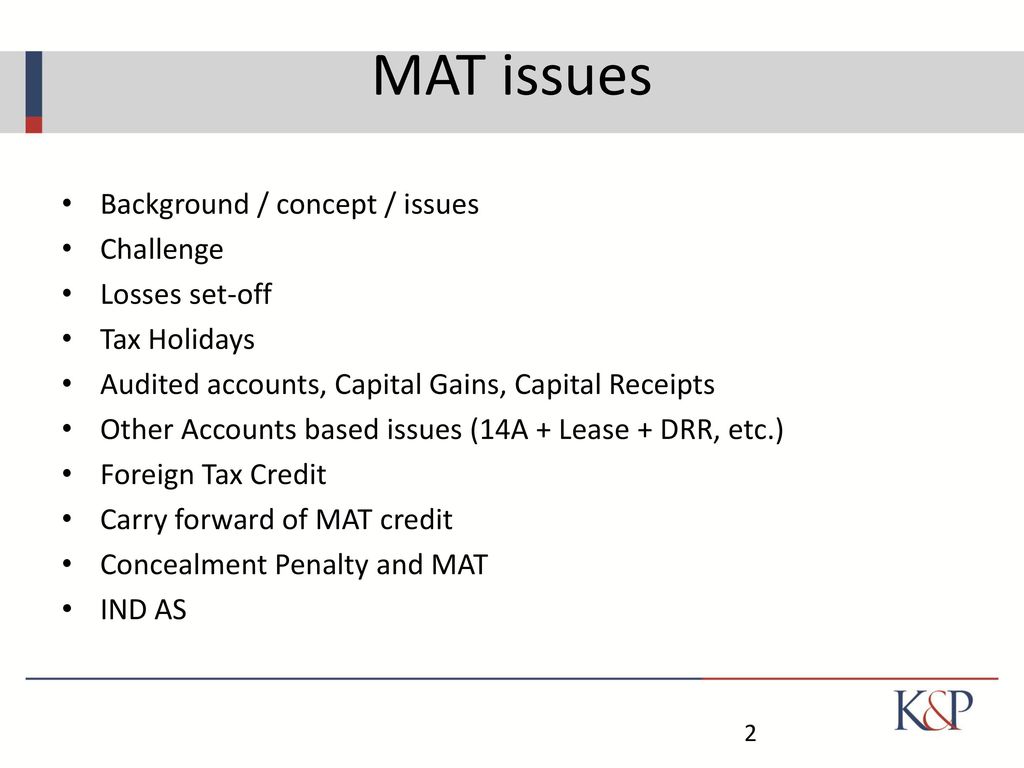

Mat on capital receipt. These are funds generated from non operating activities of a business hence are not shown inside the income statement instead they are shown inside a balance sheet. The cash received by qrs company was a capital receipt. The capital receipts are thus not chargeable to tax unless specific provisions are inserted in the act. Can capital receipts be subject to mat u s 115jb.

Capital invested in the business by a new partner. Cash from the sale of fixed assets either tangible or intangible. Can also include a payment associated with an insurance claim from a damaged fixed asset. Capital receipts refer to incoming cash flows receipts originating from one of the following three sources.

Cash from the sale of shares in the business. Amount of loan received by the company from a bank. Cash received from sale of fixed assets. Can these items be subject to mat u s 115jb.

The company debited its bank account and credited its equity account in the books of accounts. All receipts and all outlays have to be routed through the p l account as per schedule iii to the companies act 2013. Can capital receipts be subject to tax under mat. Other common examples of capital receipts.

Itat held that it is not in dispute that the subject mentioned receipt of rs. Capital receipts are funds received by a business which are not revenue in nature lead to an overall increase in the total capital of a company. Cash from the issuance of a debt. In other words an accompanying law is a sine qua non for the levy or collection of any tax.

12 65 75 000 representing forfeiture of share warrants is only a capital receipt by its nature not chargeable to tax. They are non recurring in nature which means that they don t.