Mat Meaning In Income Tax

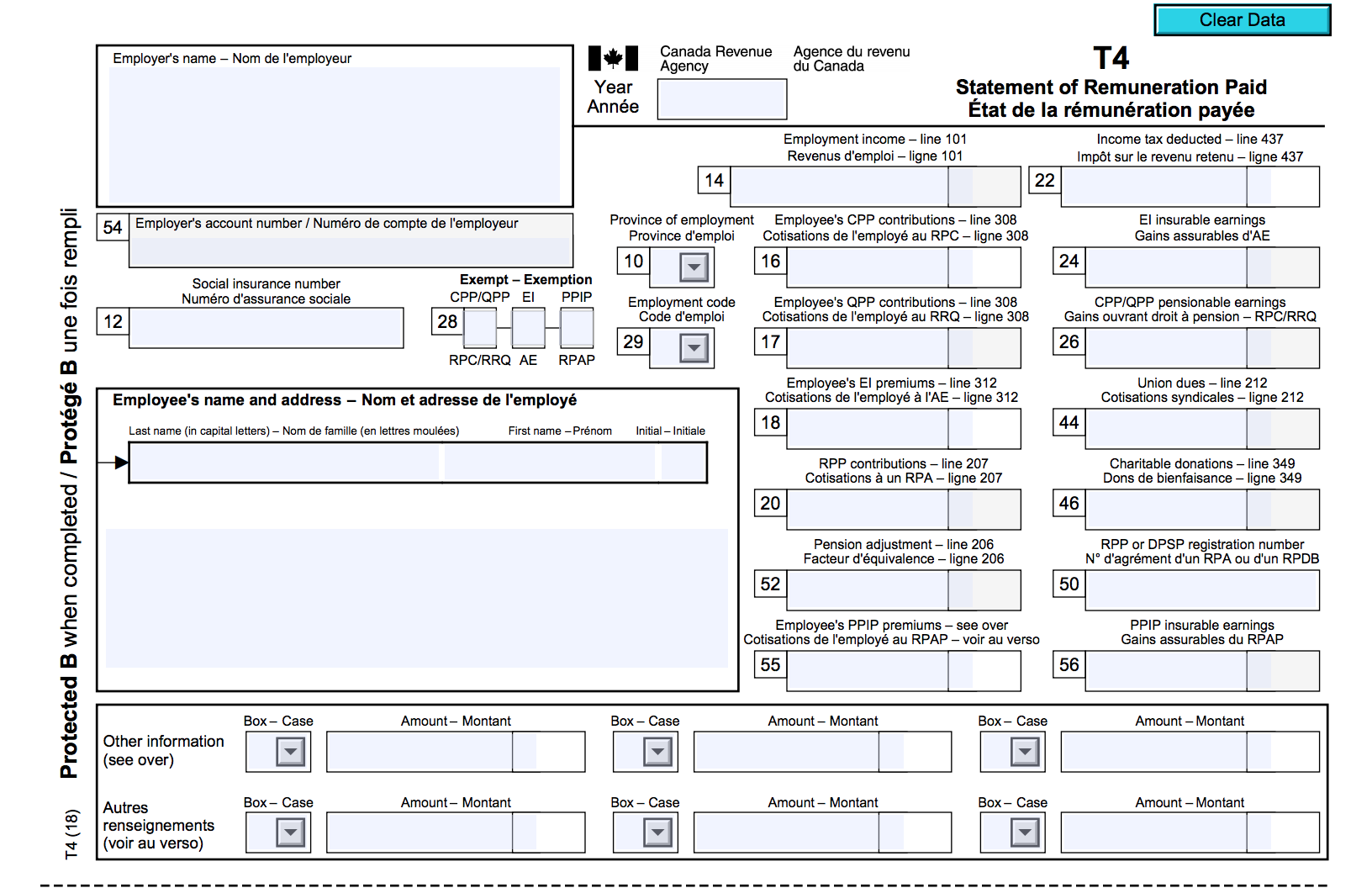

Income tax computed as per provision of section 115jb of income tax act.

Mat meaning in income tax. Under the provisions of section 115jb where the income tax calculated under the income tax act is less than 18 5 of the book profit then such book profit shall be deemed to the total income of the assessee and tax payable by the assessee shall be 18 5 on book profits. In this case mat is higher than the normal tax liability and hence the company is eligible for mat credit as per section 115jaa. Tax liability of a company for fy 2019 20 under normal provisions of the income tax act is rs. But here only mat on company s u s 115jb is discussed.

Mat a brief introduction. The mat credit is available in respect of mat paid under section 115jb of the income tax act 1961 with effect from asst. Due to increase in the number of zero tax paying companies mat was introduced by the finance act 1987 with effect from assessment year 1988 89. Meaning of book profit book profit is defined in the explanation 1 to section 115jb as book profit means the net profit as shown in the profit loss account for the relevant previous year and as increased and decreased by some prescribed items.

The promulgated ordinance reduced the mat rate of tax for ay 2020 21 to 15 per cent but did not amend section 115jaa related to mat credit. Minimum alternative tax is payable under the income tax act. In the case of a foreign company interest royalty or technical fees chargeable to tax under sections 115a to 115bbe or capital gain arising on transactions in securities if income tax payable in respect of these incomes under normal provisions other than provisions governing mat is less than the rate of mat applicable from the. In india mat is levied under section 115jb of the income tax act 1961.

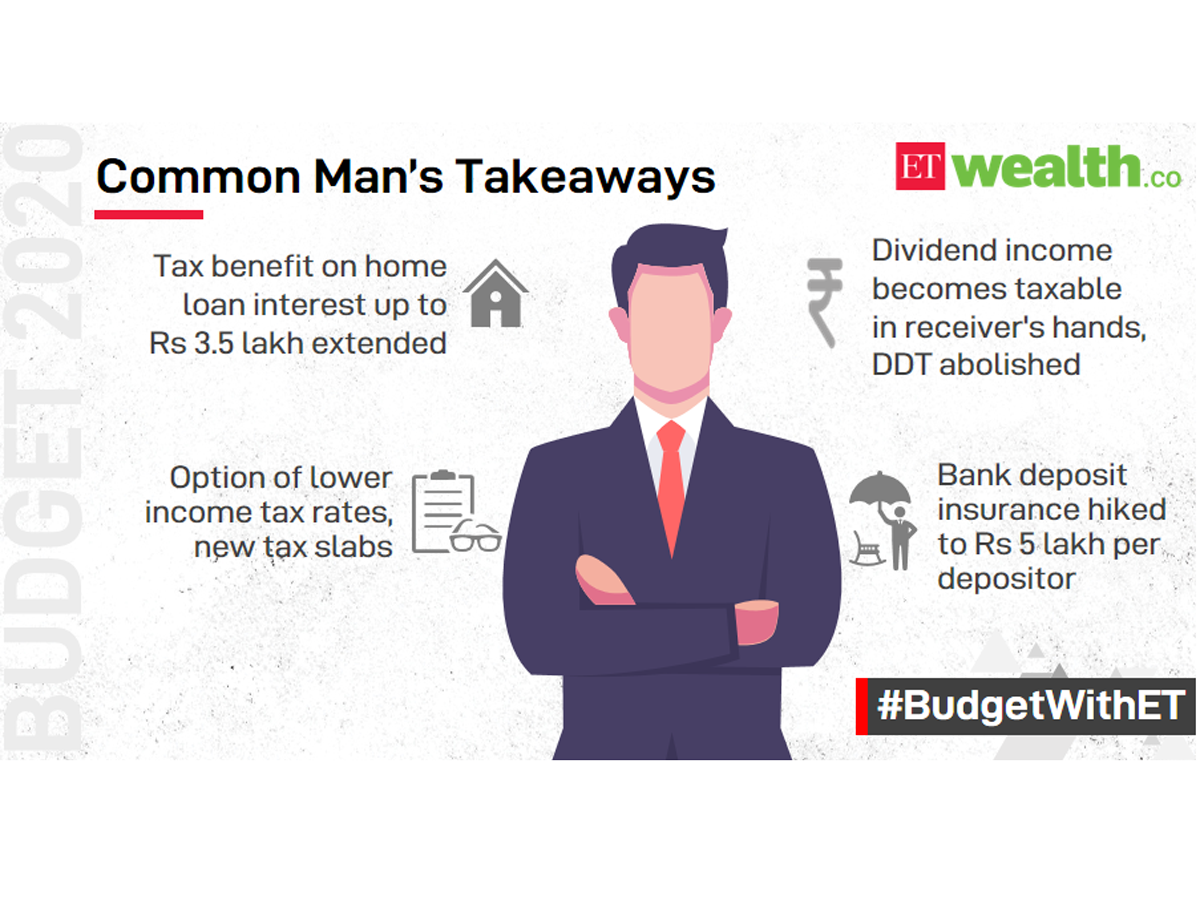

With mat companies have to pay up a minimum amount of tax to the government. 10 000 or more during a financial year as computed in. The concept of mat was introduced to target those companies that make huge profits and pay the dividend to their shareholders but pay no minimal tax under the normal provisions of the income tax act by taking advantage of the various deductions and exemptions allowed under the act. 8 lakh while the liability as per the provisions of mat is rs.

The amount of mat credit would be equal to the excess of mat over normal income tax liability for which mat is paid during the said assessment year. Hence cbdt issued a circular no 29 2019 dated 02 10 2019 to clarify that a domestic company which availed the benefit of the reduced tax rate by using the option under section 115baa shall not be entitled to avail the brought forward mat credit. Under the income tax act 1961 every assessee has to pay tax in advance in case the advance tax liability is rs. It was introduced in the year 1987 and.