Mat Income Tax Calculation

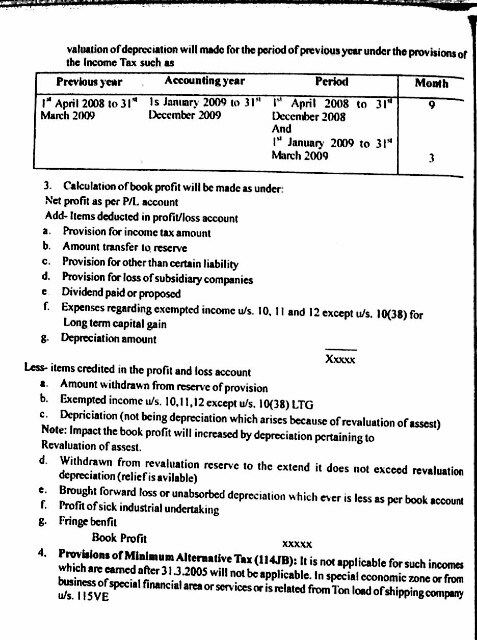

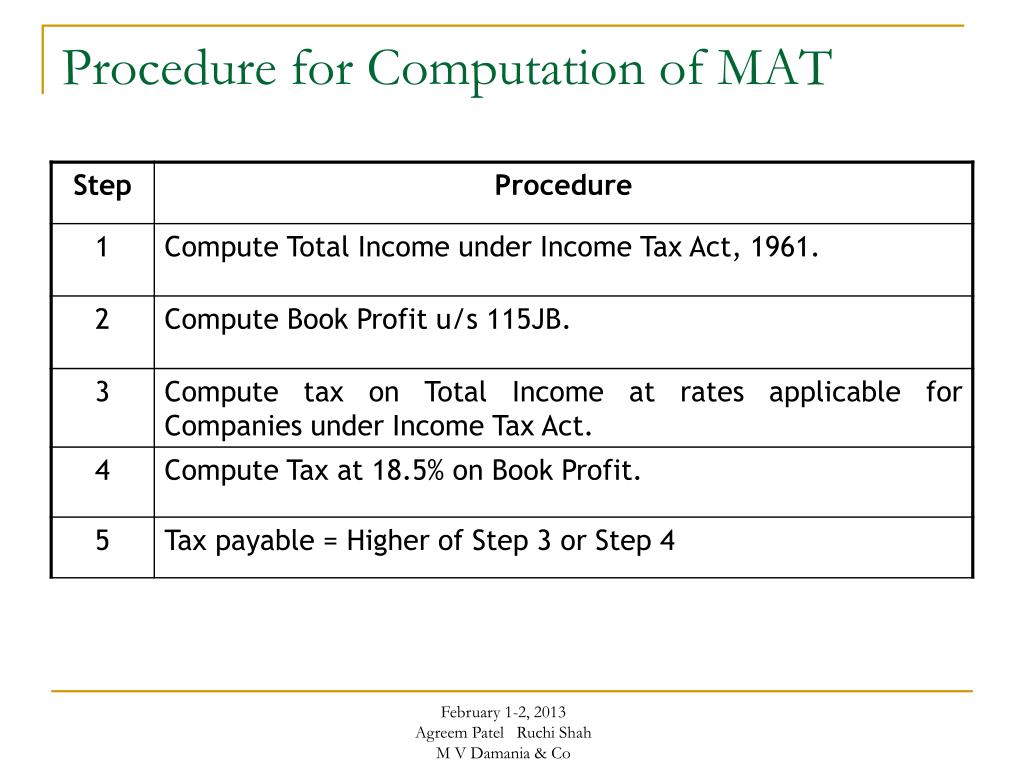

Mat is a tax levied under section 115jb of the income tax act 1961.

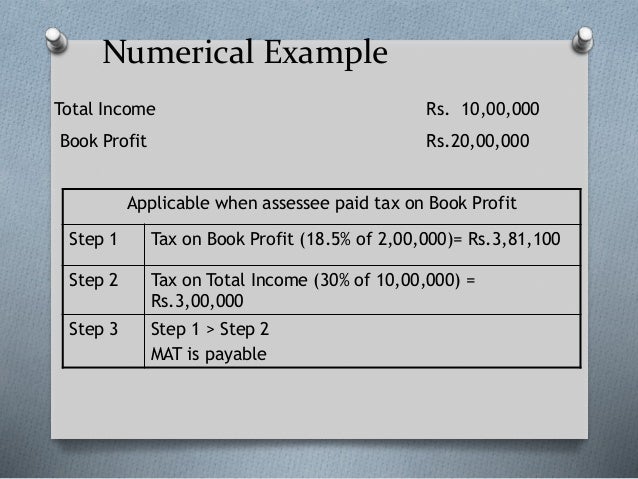

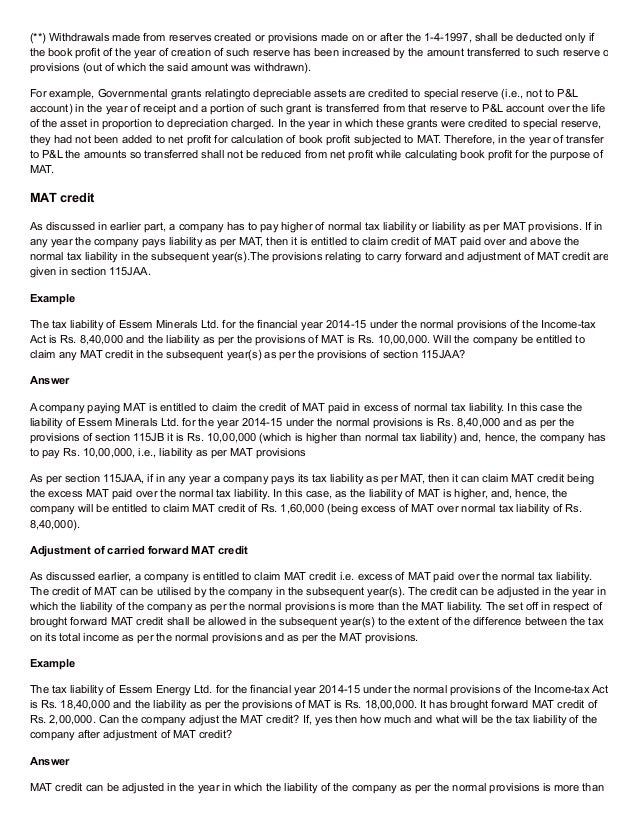

Mat income tax calculation. Before you begin gather the most recent pay statements for yourself and if you are married for your spouse too gather information for other sources of income you may have have your most recent income tax return handy keep in mind that the tax withholding estimator s results will only be as accurate as the information you enter. The concept of mat was introduced to target those companies that make huge profits and pay the dividend to their shareholders but pay no minimal tax under the normal provisions of the income tax act by taking advantage of the various deductions and exemptions allowed under the act. It was first introduced by the finance act 1987 and made effective from ay 1988 89. Payable tax cannot be less than the 18 5 of book profit in an assessment year the mat rate has been reduced to 15 from fy 19 20.

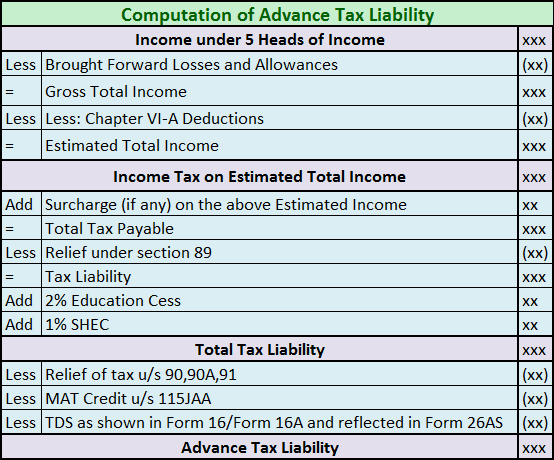

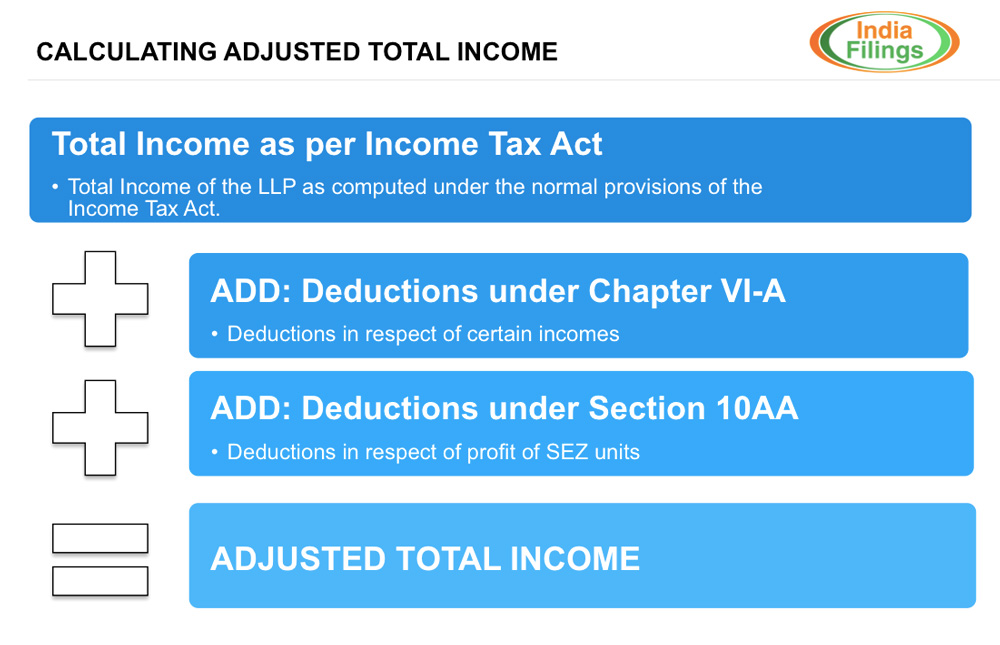

As per section 115jb all companies are required to pay corporate tax at least equal to the higher of the following. Mat a brief introduction. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. For calculating the tax outflow of company first the tax is required to be calculated.

Your household income location filing status and number of personal exemptions. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Our income tax calculator calculates your federal state and local taxes based on several key inputs. There are specific provisions under the income tax act 1961 under which the mat is collected from every company it is calculated under section 115jb of the income tax act.

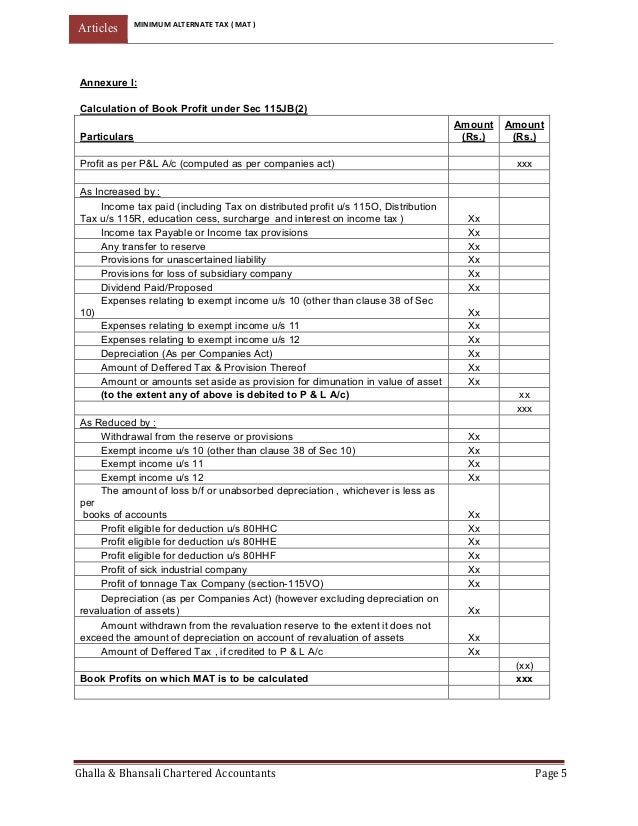

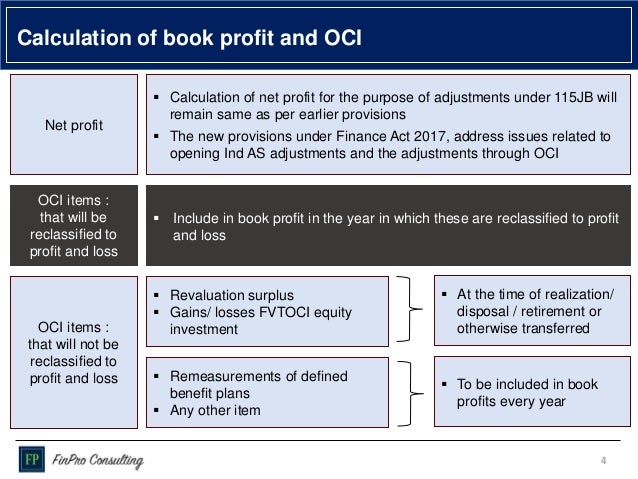

The minimum alternative tax mat is a provision introduced in direct tax laws to limit the tax deductions exemptions otherwise available to taxpayers so that they pay a minimum amount of tax to the government. Minimum alternative tax is payable under the income tax act. Minimum alternative tax mat and its computation of book profit and mat credit under section 115jb of income tax act 1961. Before proceeding on how mat is calculated first provisions related to mat calculation is important to learn.

Provisions of mat are applicable to all companies including foreign companies whose liability to pay income tax calculated as per normal provisions are less than the liability under mat provisions. Your household income location filing status and number of personal exemptions. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan.