Mat Credit Utilisation Section

Mat credit under section 115jaa.

Mat credit utilisation section. Further whether mat credit is to be utilised in immediate previous year in which tax amt as per other provision exceeds the mat or it is optional for the assessee to choose the previous year in next 10 years for utilisation of credit. As stated above only the difference between mat paid and tax liability under provisions of the act is allowed to be carried forward as mat credit the cag has analysed 88 cases in 15 states wherein the assessee had received an undue benefit of under assessment by the assessing officer a o and consequently an undue carry forward of hefty mat. Mat credit shall be allowed to be set off in a year when the tax becomes payable on the total income in accordance with the normal provisions of the act. The mat credit is available in respect of mat paid under section 115jb of the income tax act 1961 with effect from asst.

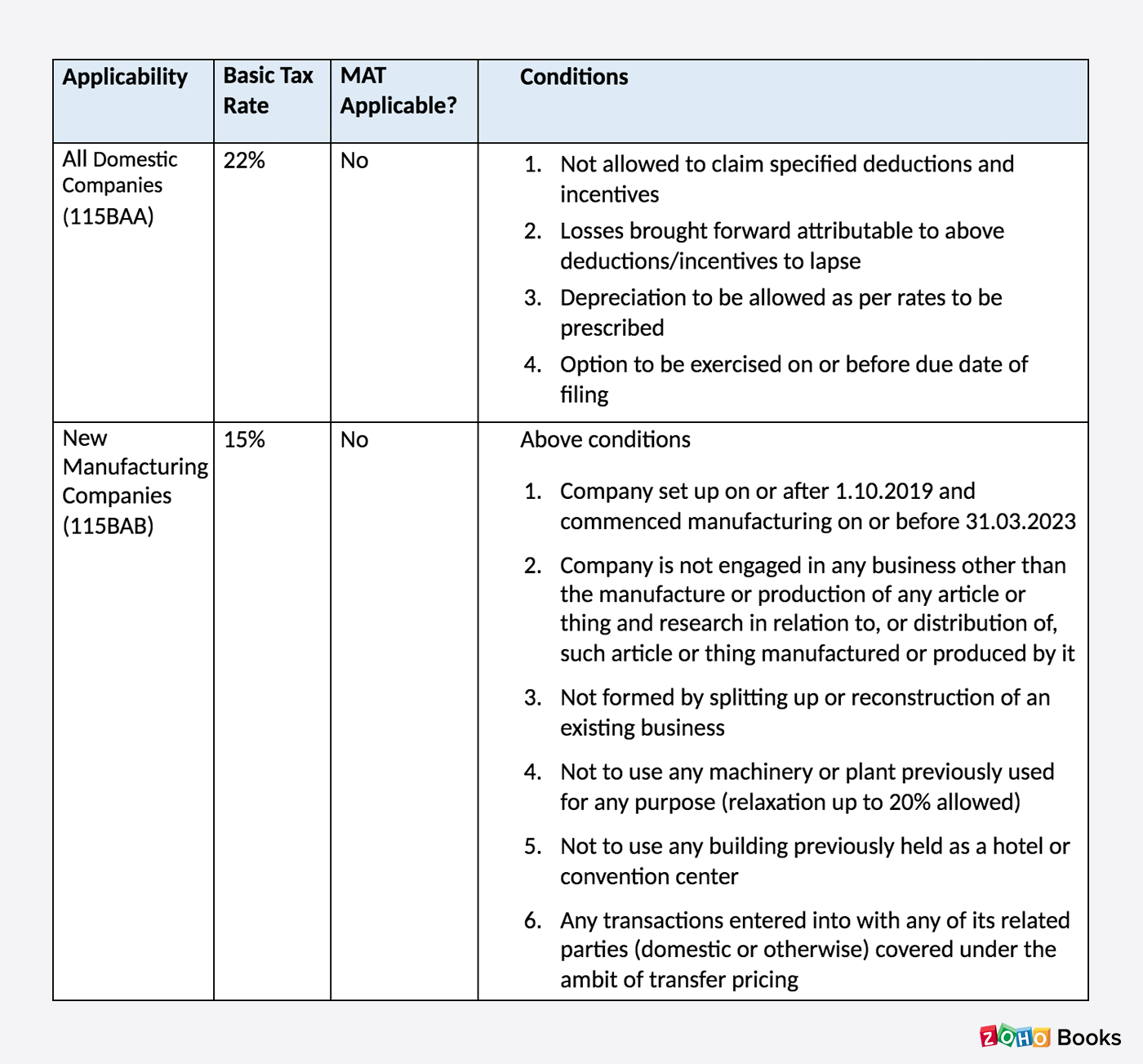

As per section 115jaa if in any year a company pays its tax liability as per mat then it can claim mat credit being the excess mat paid over the normal tax liability. 5 2 as regards allowability or brought forward mat credit it may be noted that as the provisions of section 115jb relating to mat itself shall not be applicable to the domestic company which exercises option under section 115baa it is he clarified that the tax credit of mat paid by the domestic company exercising option under section 115baa of the act shall not be available consequent to exercising of such option.