Mat Credit Meaning

This mat credit is allowed a carry forward for a period of 15 financial years.

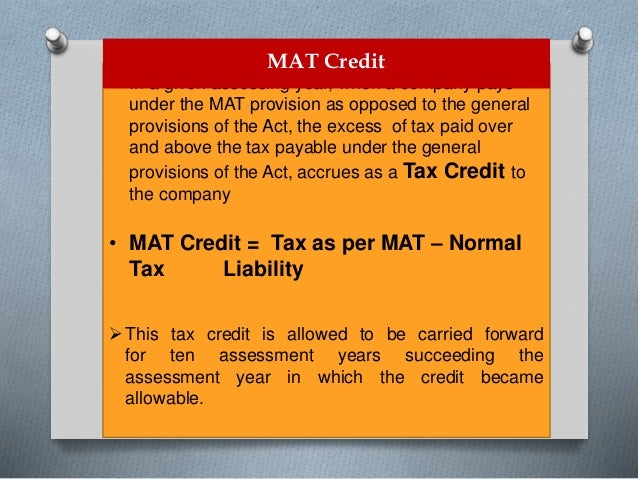

Mat credit meaning. Such tax credit shall be carried forward for 15 assessment years immediately succeeding the assessment year in which such credit has become allowable. Mat credit is the difference between the tax the company pays under mat and the regular tax. Mat or minimum alternate tax is a provision in direct tax laws to limit tax exemptions availed by companies so that they mandatorily pay a minimum amount of tax to the government. One can find provisions relating to carry forward and adjustment of mat credit in section 115jaa.

As per section 115jb all companies are required to pay corporate tax at least equal to the higher of the following. This is with effect from ay 2018 19 prior to which mat could be carried forward only for a period of 10 ays. Mat credit a new tax credit scheme is introduced by which mat paid can be carried forward for set off against regular tax payable during the subsequent seven year period subject to certain conditions as under. It was introduced to contain the practices followed by certain companies to avoid the payment of income tax even though they had the ability to pay.

Any company that pays minimum alternate tax under the mat clause instead of regular tax then if the tax paid is more than that accrued the excess amount is credited back as tax credit to the company. What is minimum alternate tax mat the concept of mat was introduced under ita to tax companies making high profits and declare dividends to their shareholders but have no significant taxable income because of exemptions deductions and incentives. If during a year a company has paid tax liability as per mat it is entitled to claim credit of excess of mat paid over the normal tax liability in the following year s. Mat is applied when the taxable income calculated as per the normal provisions in the it act is found to be less than 18 5 of the book profits.