Mat Credit In Deferred Tax Calculation

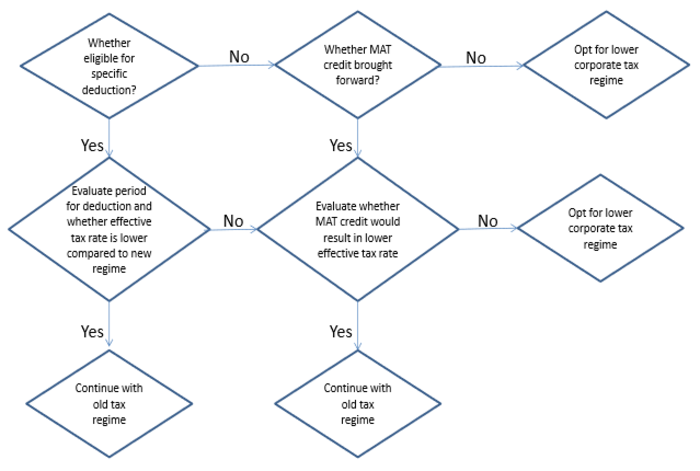

Section 115jb levies minimum alternate tax mat at 10 of book profits plus surcharge and cess thereon if such tax is higher than the tax payable under the normal provisions of the act.

Mat credit in deferred tax calculation. Whether mat credit can be considered as a deferred tax asset per as 22. The treatment of deferred tax charge in determining the tax liability under the special provisions of section 115jb of the income tax act is one such case. Minimum alternative tax mat and its computation of book profit and mat credit under section 115jb of income tax act 1961. Mat does not give rise to any difference between book income and taxable income.

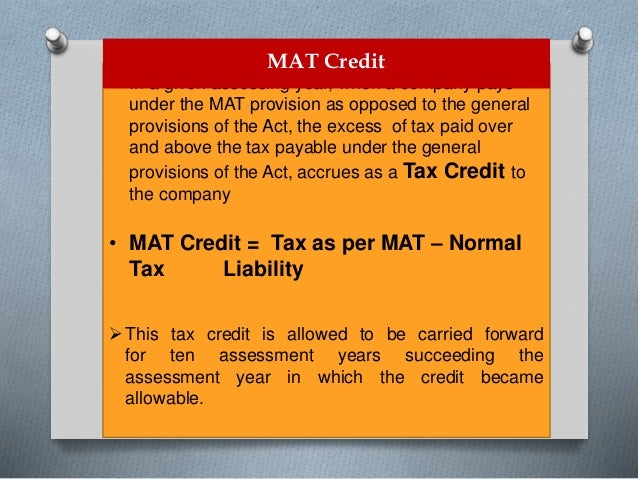

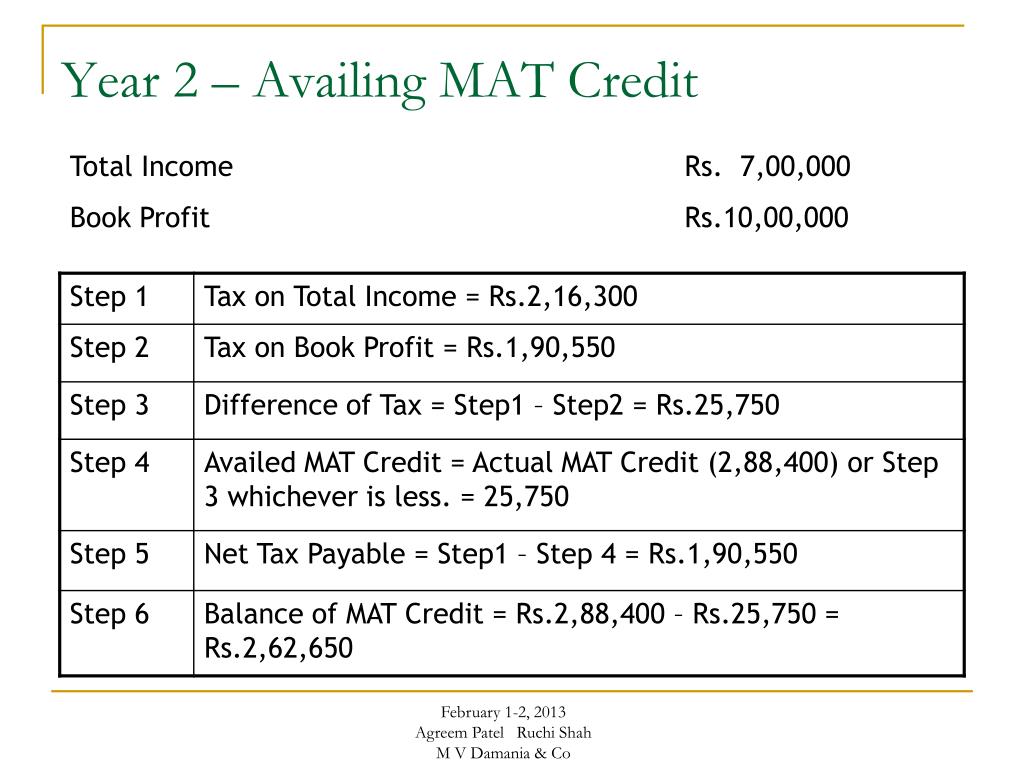

If during a year a company has paid tax liability as per mat it is entitled to claim credit of excess of mat paid over the normal tax liability in the following year s. Tax paid as per mat calculation income tax payable under normal provision of income tax act 1961. The continue reading how to measure deferred tax when a company pays tax as per mat. 11 april 2008 1 when ur income is more as per income tax act than the income as per companies act deferred tax asset arises.

2 when ur income is less as per income tax act than the income as per companies act deferred tax liability arises. 1 lakh the tax liability as per the normal provisions for fy 2019 20 is rs. The maximum amount of mat credit that you can claim cannot exceed the difference between the normal tax liability and the mat liability in the year for which the mat credit is being availed. According to as 22 deferred tax asset arise on account of differences in the items of income and expenses credited in the p l a c.

If a company has mat credit of rs. 3 for provisions of mat refer sec 115jb of the it act 1961. The common features of mat are as under. The minimum alternative tax mat is a provision introduced in direct tax laws to limit the tax deductions exemptions otherwise available to taxpayers so that they pay a minimum amount of tax to the government.

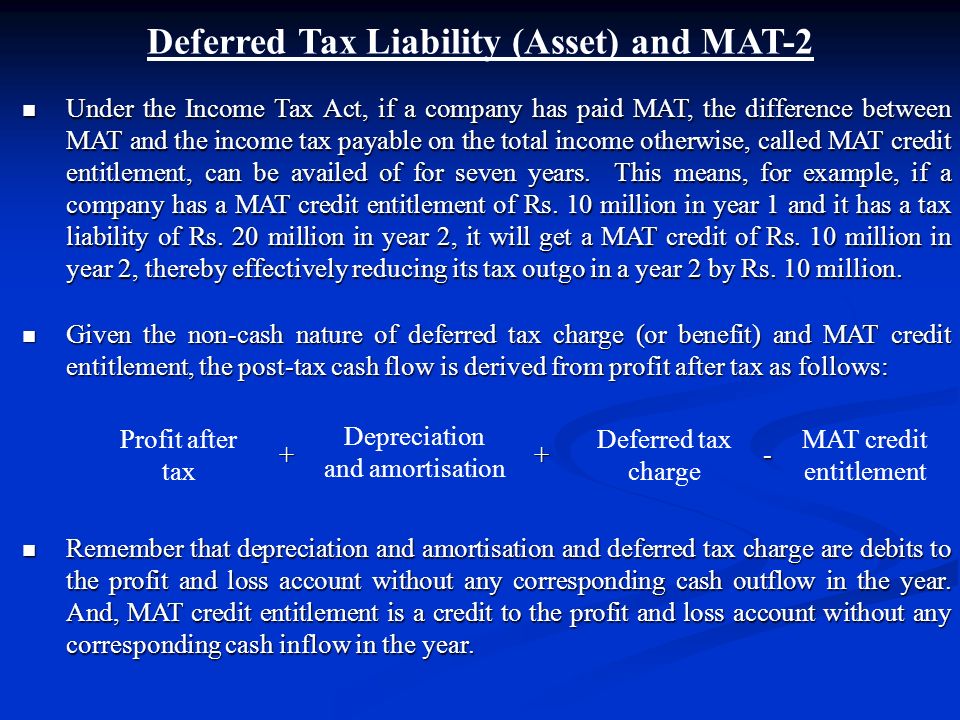

As per as 22 deferred tax assets and liability arise due to the difference between book income taxable income and do not rise on account of tax expense itself. It is the amount of income tax determined to be payable recoverable in respect of the taxable income tax loss for a period. When any amount of tax is paid as mat by the company then it can claim the credit of such tax paid in accordance with the provision of section 115jaa. How to measure deferred tax when a company pays tax as per mat terms to be known.

It is the tax effect of timing differences. In case of conversion of the company into a limited liability partnership under the limited liability partnership act 2008 mat credit available in hands. In view of this it is not appropriate to consider mat credit as deferred tax asset for the purposes of as 22 2 whether mat credit can be considered as an asset. 10 lakh while that as per the.