Mat Credit Carry Forward For 15 Years Amendment

2 15 when liability to mat arises.

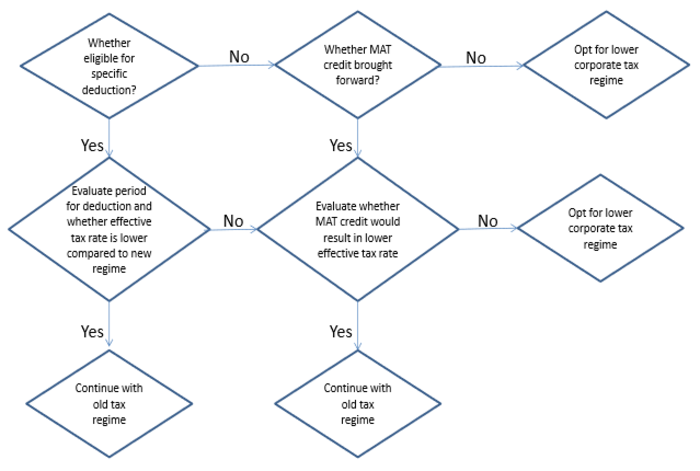

Mat credit carry forward for 15 years amendment. Mat credit is not a deferred tax asset as per as 22 on accounting for taxes on income issued by icai deferred tax liability or deferred tax asset arises on account of timing differences i e. The finance bill 2017 proposes to amend section 115jaa of the. Now after setting off carry forward losses the total income liable to tax comes to rs. The mat credit so determined can be carried forward for set off for five succeeding years from the year in which mat credit becomes allowable proposed amendment in finance act 2006 7 years.

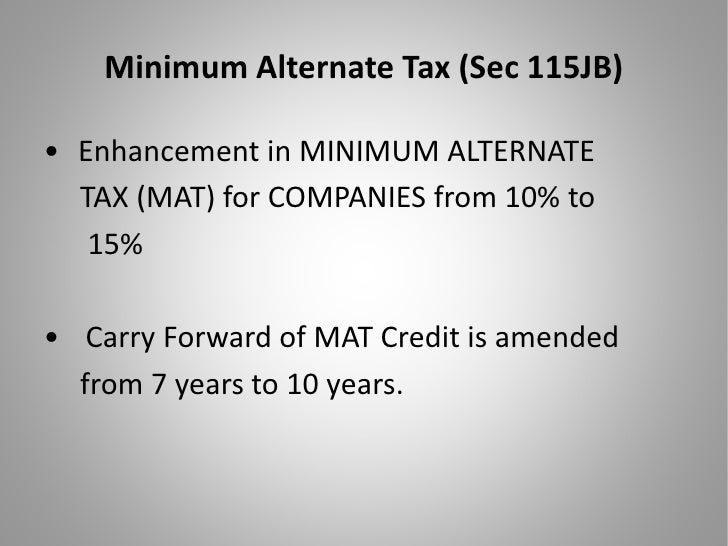

The tax credit determined u s 115jaa of the income tax act 1961 is allowed as a set off in a year in which tax is payable on the total income computed in accordance with the normal. 115jaa 3a has increased the period of carry forward of mat credit from 7 assessment years to 10 assessment years. This is with effect from ay 2018 19 prior to which mat could be carried forward only for a period of 10 ays. Such tax credit shall be carried forward for 15 assessment years immediately succeeding the assessment year in which such credit has become allowable.

With a view to provide relief to the assessees paying mat it is proposed to amend section 115jaa to provide that the tax credit determined under this section can be carried forward up to the 15th assessment year immediately succeeding the assessment years in which. This said and when the income tax law permits carry forward of mat credit for period of 15 years a pertinent question that merits consideration is whether circular no 29 2019 dated october 2 2019 issued by the cbdt lies in tandem with the provisions of the statute. 30 1 principles governing carry forward and set off of mat credit. 09 march 2012 a company has a carry forward loss of rs.

The amount of mat credit would be equal to the excess of mat over normal income tax for the assessment year for which mat is paid. Due to increase in the number of zero tax paying companies mat was introduced by the finance act 1987 with effect from assessment year 1988 89. 27 7 brought forward losses at the beginning of the year becomes nil at the end of year due to reduction of capital. 7 crs and mat credit of say 1 5 crs.

The tax liability on the same comes to rs. 3 32 crores and the mat liability comes to rs 3 38 crores. 2 act 2009 by amending s. Rs 14 43 000 rs 12 48 000 rs 1 95 000.

Currently tax credit can be carried forward up to the 10th assessment year. In this regard the following aspects need to be considered. The current year profit is rs. Profits of a sick industrial company.