Mat Computation Income Tax

Previously the mat credit was allowed to carry forward for a period of 10 years but from ay 2018 19 it can be carried forward for 15 assessment years.

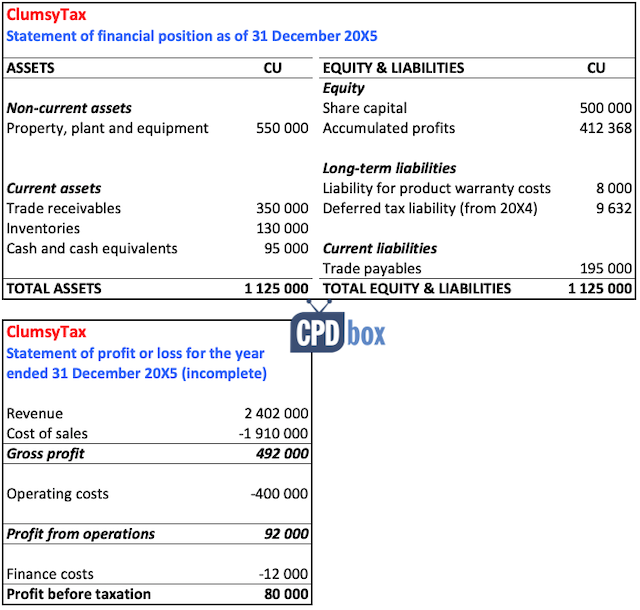

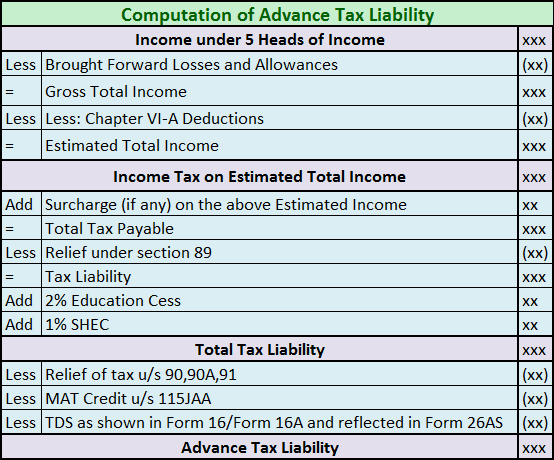

Mat computation income tax. Tax on total income computed as per the normal provisions of the act by charging applicable normal rates and special rates if any income included in the total income of the company is taxable at special rates. Now compute tax payable as per mat provisions tax payable 18 5 surcharge 7 19 795 of 1 01 00 000 19 99 295. Minimum alternate tax calculation example. Calculation of book profits for the purpose of mat maximum alternate tax section 115jb for computation of book profit one may proceed as follows.

When the tax is paid on the standard computation of a company s income it is known as normal tax. Tax paid as per mat calculation income tax payable under normal provision of income tax act 1961. Under existing rules book profit is calculated as per section 115jb of the income tax act 1961. The tax computed by applying 15 plus surcharge and cess as applicable on book profit is called mat.

It means the rate of mat is reduced to 15 percent from the ay 2020 21 itself. The amount of tax and surcharge cannot exceed the tax calculate under marginal relief. Step 1 find out net profit before other comprehensive income oci as per statement of profit and loss of the company. However the rate of income tax under section 115jb shall be reduced rate of 15 percent instead of 18 5 per cent with effect from assessment year commencing on or after the 1st day of april 2020.

As per section 115jb every taxpayer being a company is liable to pay mat if the income tax including surcharge and cess payable on the total income computed as per the provisions of the income tax act in respect of any year is less than 18 50 of its book profit surcharge sc health education cess. When any amount of tax is paid as mat by the company then it can claim the credit of such tax paid in accordance with the provision of section 115jaa. Mat is calculated as 15 of the book profit of the tax assesse. Where in case of a company the income tax payable on the total income as computed under the income tax act in respect of any previous year is less than 15 of its book profit then such book profit shall be deemed to be the total income of the assessee and the tax payable on such total income shall be the amount of income tax at the rate of 15.

Tax computed 15 plus surcharge and cess as applicable on book profit manner of computation of book profit is discussed in later part.