Mat Computation Format

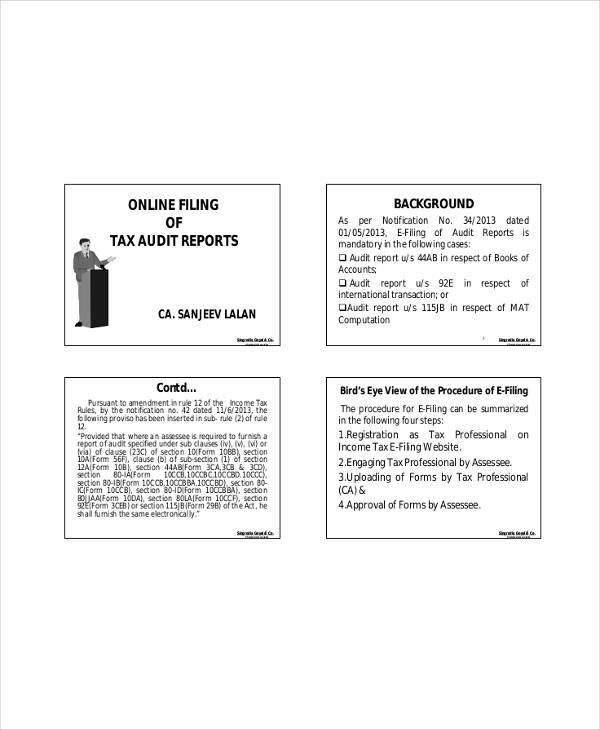

The concept of mat was introduced to target those companies that make huge profits and pay the dividend to their shareholders but pay no minimal tax under the normal provisions of the income tax act by taking advantage of the various deductions and exemptions allowed under the act.

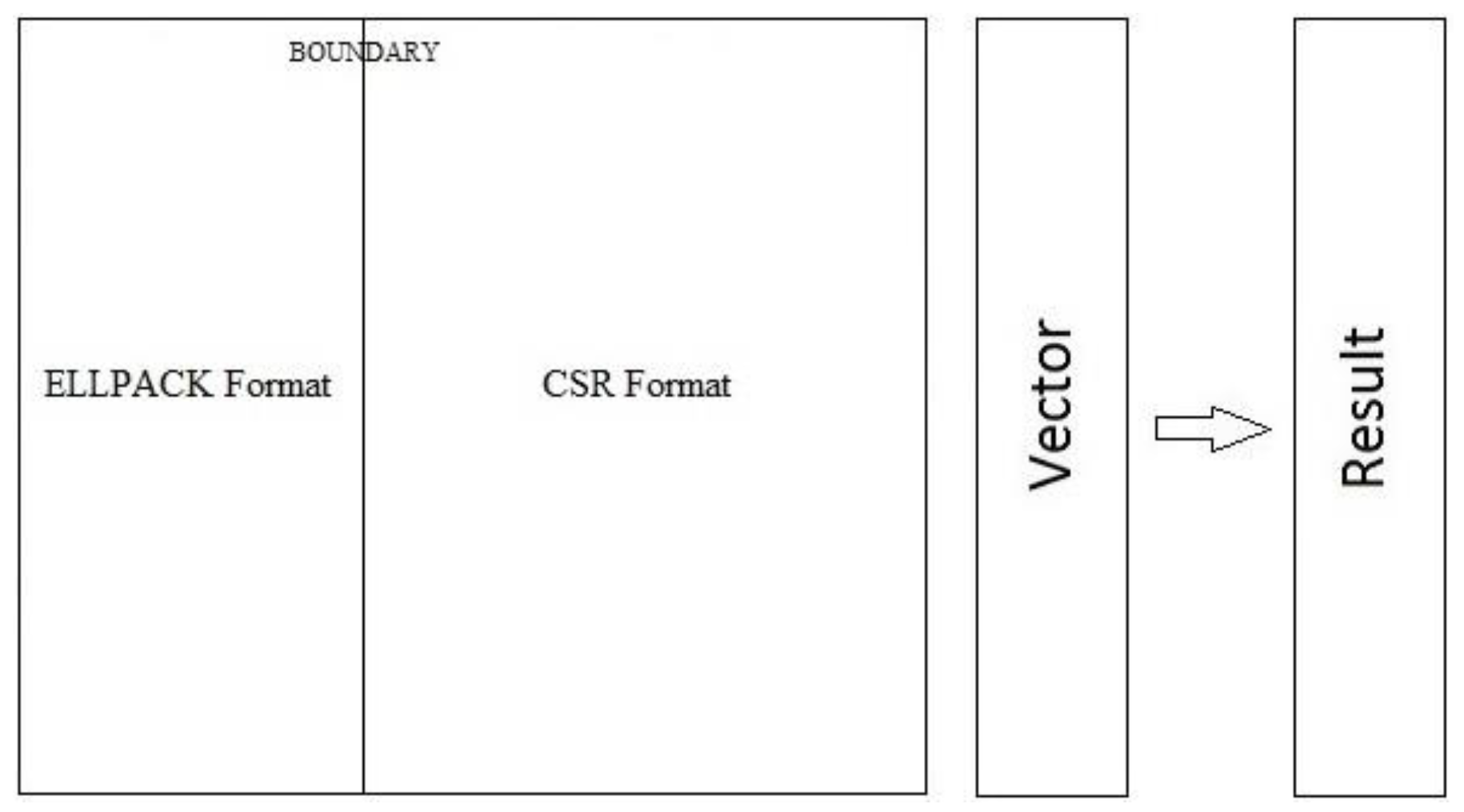

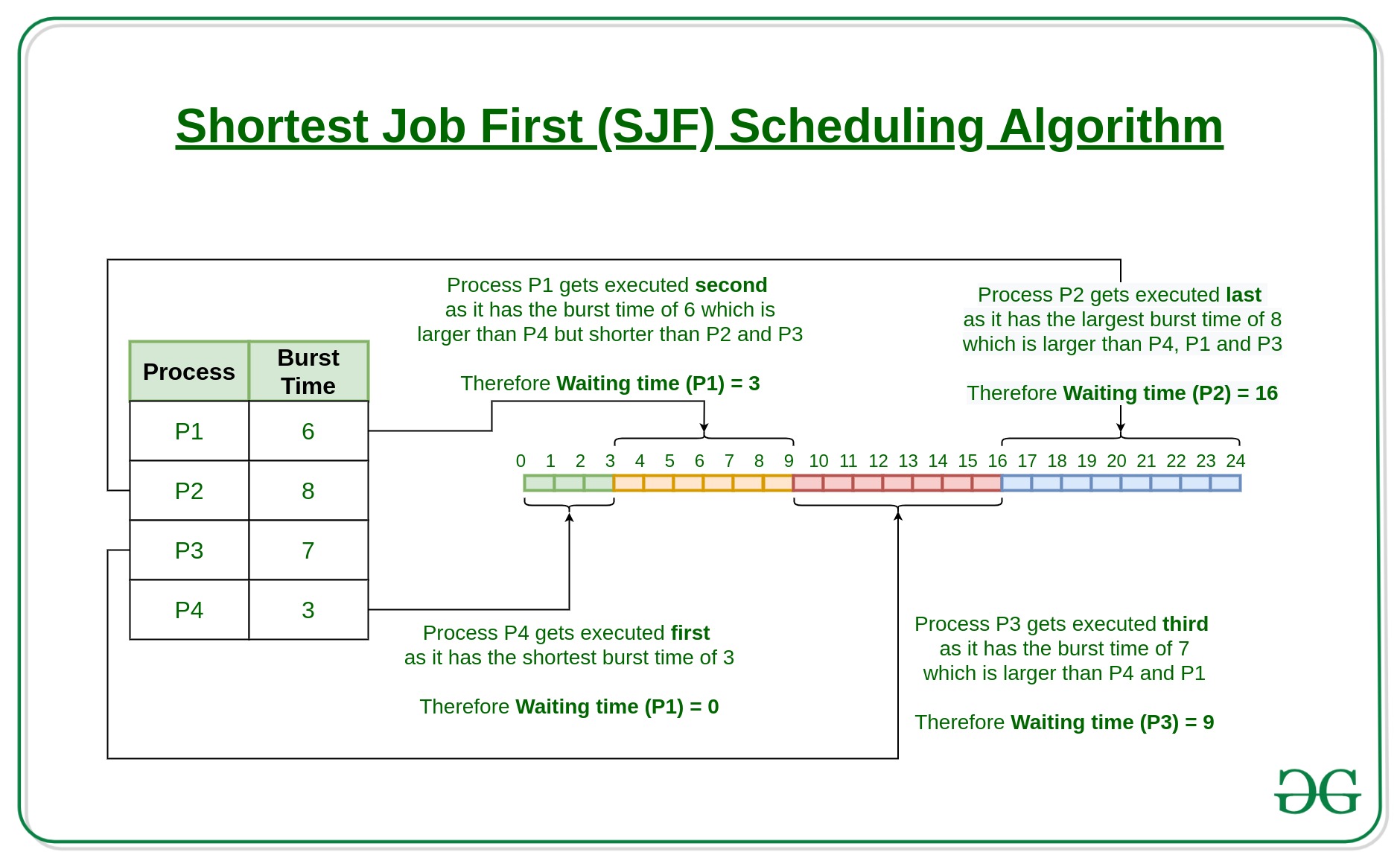

Mat computation format. Mat level 4 files are compatible with matlab version 4 and lower while mat 5 files are compatible with matlab version 5 and higher versions. Before proceeding on how mat is calculated first provisions related to mat calculation is important to learn. Native data format of the matlab numerical computation software. Tax on total income computed as per the normal provisions of the income tax act 30 on domestic companies and 40 on foreign companies.

Stores numerical matrices boolean values or strings. Minimum alternative tax is payable under the income tax act. Further to check whether the dtl dta can be carried forward the calculation is done for next 5 years to be bring it in conformity with the recognition criteria mentioned under as 22. Mat a brief introduction.

The minimum alternative tax mat is a provision introduced in direct tax laws to limit the tax deductions exemptions otherwise available to taxpayers so that they pay a minimum amount of tax to the government. Minimum alternative tax mat and its computation of book profit and mat credit under section 115jb of income tax act 1961. Download excel format to calculate deferred tax mat and computation of tax for 5 a y. The tax computed by applying 15 plus surcharge and cess as applicable on book profit is called mat.