Mat Computation Format In Excel 2014 15

All sec 10 exemptions computes on updating the tax saving details based on the income tax criteria.

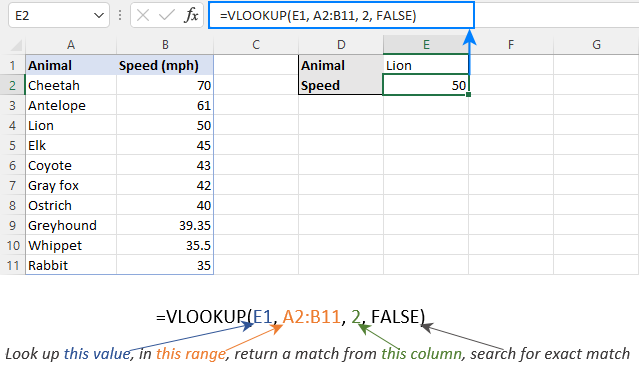

Mat computation format in excel 2014 15. Before proceeding on how mat is calculated first provisions related to mat calculation is important to learn. 1 lakh the tax liability as per the normal provisions for fy 2019 20 is rs. All deductions exempted income all are covered in one computation work like mini software. How to subtract in excel.

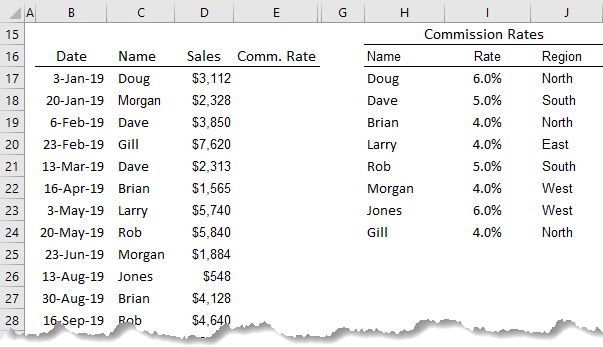

10 lakh while that as per the. Download free income tax calculator fy 2014 15 in excel taxation time started everyone is busy in calculating their income tax to be paid by end of march 2015. If a company has mat credit of rs. Download automatic mat calculator in excel format xlsx version with case laws.

Posted on 10 september 2020 downloads. Sir individual computation copy shheet send to my mail not for salary income. It has been seen that there are chances of wrong calculation of income tax if done manually. Mat is levied at the rate of 9 plus surcharge and cess as applicable in case of a company.

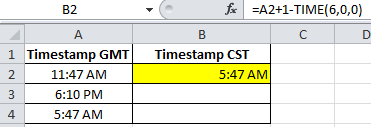

Income tax calculator for fy 2014 15 ay 2015 16. The maximum amount of mat credit that you can claim cannot exceed the difference between the normal tax liability and the mat liability in the year for which the mat credit is being availed. Time is a time worksheet function in excel which is used to make time from the arguments provided by the user the arguments are in the following format respectively hours minutes and seconds the range for the input for hours can be from 0 23 and for minutes it is 0 59 and similar for seconds and the method to use this function is as follows time hours minutes. The concept of mat was introduced to target those companies that make huge profits and pay the dividend to their shareholders but pay no minimal tax under the normal provisions of the income tax act by taking advantage of the various deductions and exemptions allowed under the act.

Excel can perform an array of basic math functions and the articles listed below will show you how to create the necessary formulas to add subtract multiply or divide numbers. Also learn how to work with exponents and basic mathematical functions. Time formula in excel. The excel based income tax calculator are easy to calculate the tax including correct measure of taxation slabs and deduction.

Salient features of the simple tax calculator simple tax calculator for the use of salaried employees of govt and private sector. Provisions of mat are applicable to all companies including foreign companies whose liability to pay income tax calculated as per normal provisions are less than the liability under mat provisions. Computation for f y 2019 20 a y 2020 21. The tax computed by applying 15 plus surcharge and cess as applicable on book profit is called mat.

Easy use of calculator key in the salary details and investment tax saving details yellow colored cell to compute the tax. March 14 2018 at 2 12 pm. Income tax computation calculator for f y 2019 20.