Mat Computation For Ay 13 14

Before proceeding on how mat is calculated first provisions related to mat calculation is important to learn.

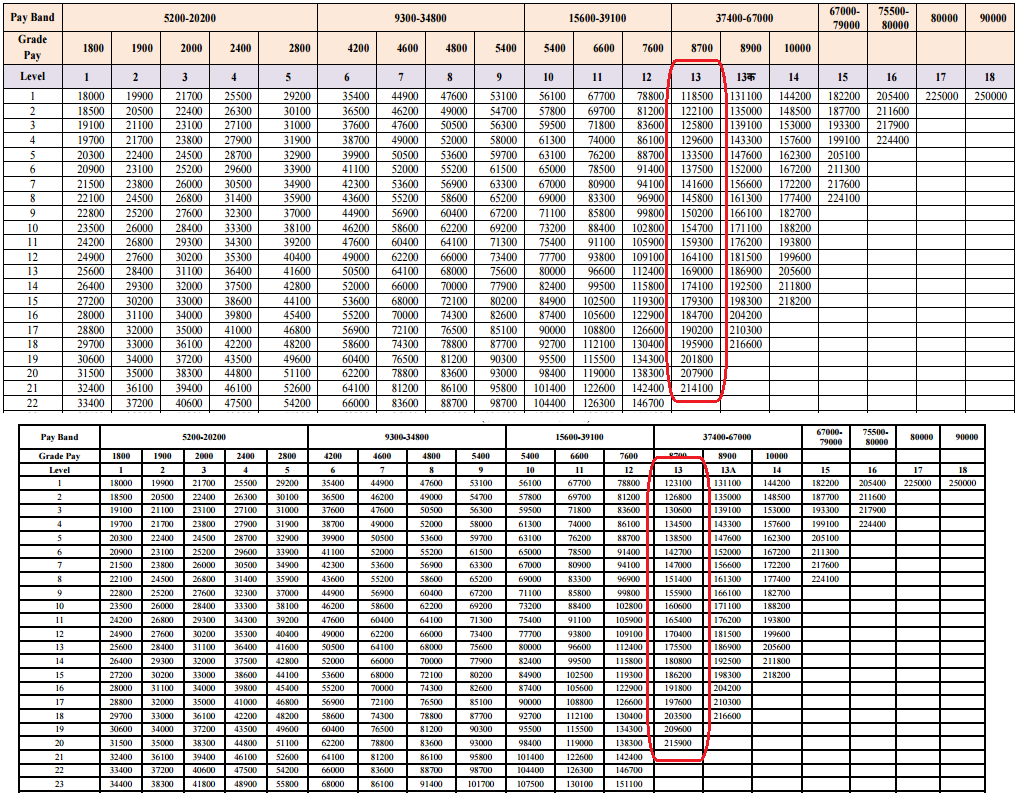

Mat computation for ay 13 14. Rs 75 00 000 18 5 plus 4 rs 14 43 000. This is with effect from ay 2018 19. The tax computed by applying 15 plus surcharge and cess as applicable on book profit is called mat. I think mat is applicable to every company wheather big or small no condition should satisfy for applicability of mat is there any objection to my criteria is there any limit or any condition should satisfy for applicability of mat to the companies income tax others.

Hence tax payable by the company will be rs 14 43 000. Download income tax calculator for a y. Analysis of provision of section 115jb where in case of a company the income tax payable on the total income as computed under the income tax act in respect of any previous year is less than 15 of its book profit then such book profit shall be deemed to be the total income of the assessee and the tax. Income tax slab rates from ay 1992 93 to ay 2015 16 download income tax calculator for a y.

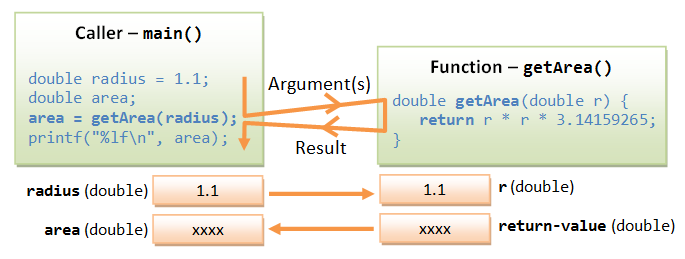

Calculation of book profits for the purpose of mat maximum alternate tax section 115jb for computation of book profit one may proceed as follows. Income tax calculator fy 2012 13 ay 2013 14. Income tax rates are decided and governed by income tax act 1961 and are subject to change every year. Rs 14 43 000 rs 12 48 000 rs 1 95 000.

Provisions of mat are applicable to all companies including foreign companies whose liability to pay income tax calculated as per normal provisions are less than the liability under mat provisions. Tax rates are for assessment year 2012 13 assessment year 2011 12 assessment year 2010 11 ay 2009 10 basic rates for companies are same however surcharge has been reduced to 5 from 10 dividend distribution tax rate are same in last four years mat minimum alternate tax rate has been increased in last four years. Income tax calculator for fy 2006 07 to fy 2016 17. 2012 13 2011 12 2010 2011 tags.

Such tax credit shall be carried forward for 15 assessment years immediately succeeding the assessment year in which such credit has become allowable. Book profit calculator downloads income tax calculator section 115jb. Applicability of mat mat is applicable to all companies including the foreign companies. This article will cover the income tax rates applicable to domestic companies for the assessment year 2019 2020 and assessment year 2020 2021 as per the taxation laws amendment act 2019 respectively also cover minimum alternate tax mat provisions alongwith calculation of book profit.

Computation of book profit is discussed in later part. Income tax slab from assessment year 2001 2002 to a y.