Mat Calculation Format In Excel

While preparing the utility author of the utility has considered various income tax cases decided by various judicial authorities both in favour of assessee and in favour of revenue.

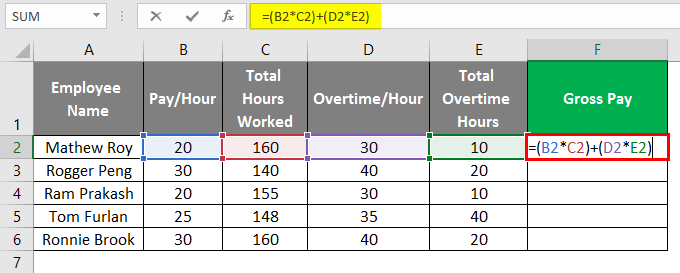

Mat calculation format in excel. The tax rate is 15 with effect from ay 2020 21 fy 2019 20 2. Excel can perform an array of basic math functions and the articles listed below will show you how to create the necessary formulas to add subtract multiply or divide numbers. What matlab data structure do you want to use for storing your xls file. Measure your art enter the measurement of your art and the border size and our custom mat calculator will do the math.

Download excel format to calculate deferred tax mat and computation of tax for 5 a y. Tax liability as per the mat provisions are given in sec 115jb 18 5 of book profits plus 4 education cess plus a surcharge if applicable. Average 1 3 5 7 10 the best way to calculate an average is to input your values into separate cells in a single column. If you are cutting multiple mats add a title to identify the artwork and print off.

You now have a cutting list for each mat you need. How to calculate mat. To convert a xls file to a mat file you need to decide the data structure. To use an average formula in excel open your formula with average and then input your values.

Separate each number with a comma. Mat is equal to 18 5 15 from ay 2020 21 of book profits plus surcharge and cess as applicable. Further to check whether the dtl dta can be carried forward the calculation is done for next 5 years to be bring it in conformity with the recognition criteria mentioned under as 22. We have attached below an excel utility to compute the mat as per provisions of section 115jb of income tax act 1961.

How to calculate mat. When you press enter excel will calculate and output the average. S k on 20 jul 2016. Download automatic mat calculator in excel format with case laws.

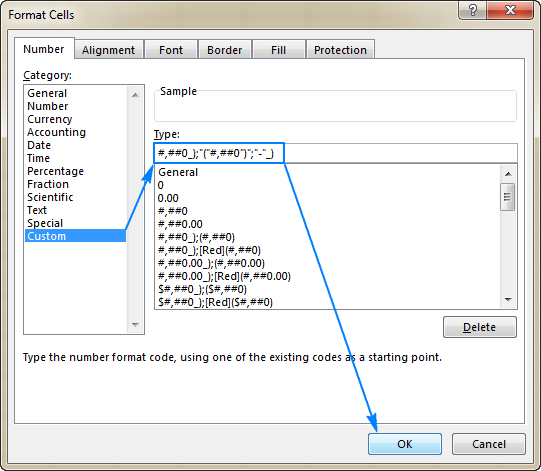

From format cells dialog box we can see that the way number currency date time or percentage will be displayed can be changed by making an appropriate selection. Net profit as per profit and loss account exprot income add where the following are debited to p l a c. 18 june 2008 there is a specific format prescribed under section 115jb of income tax act.