Mat Calculation For Fy 2017 18

The taxation laws amendment bill 2019 proposed to insert a proviso to section 115jb 1 of the act that the rate shall be reduced from 18 5 to 15 from previous year commencing on or after april 1 2020.

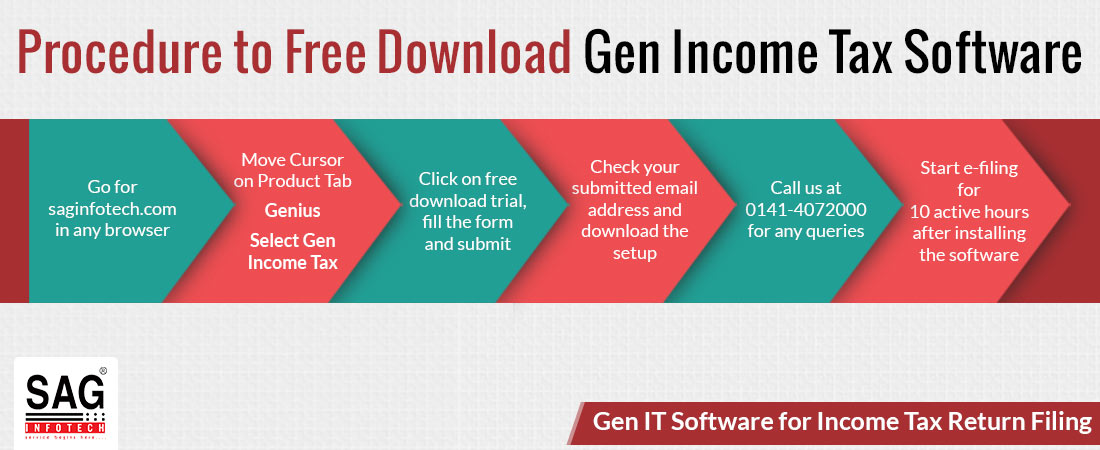

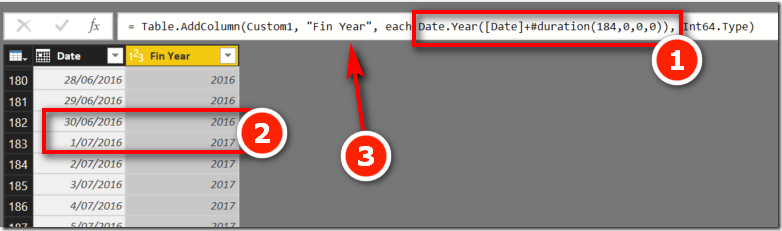

Mat calculation for fy 2017 18. Tax computed as per the normal provisions of the income tax law i e by applying the relevant tax rate to the taxable income of the company. How much tax you save from budget 2017 download fy 2017 18 income tax calculator 4. 1 crore ec shec or hec. In the below income tax calculator india enter your net income gender and mode of tax payer and click calculate.

A domestic company is taxable at the rate of 25 if its turnover or gross receipt does. It means as per the bill the reduced rate of 15 per cent for mat is applicable from ay 2021 22. How to calculate mat. Tax liability as per the mat provisions are given in sec 115jb 18 5 of book profits plus 4 education cess plus a surcharge if applicable.

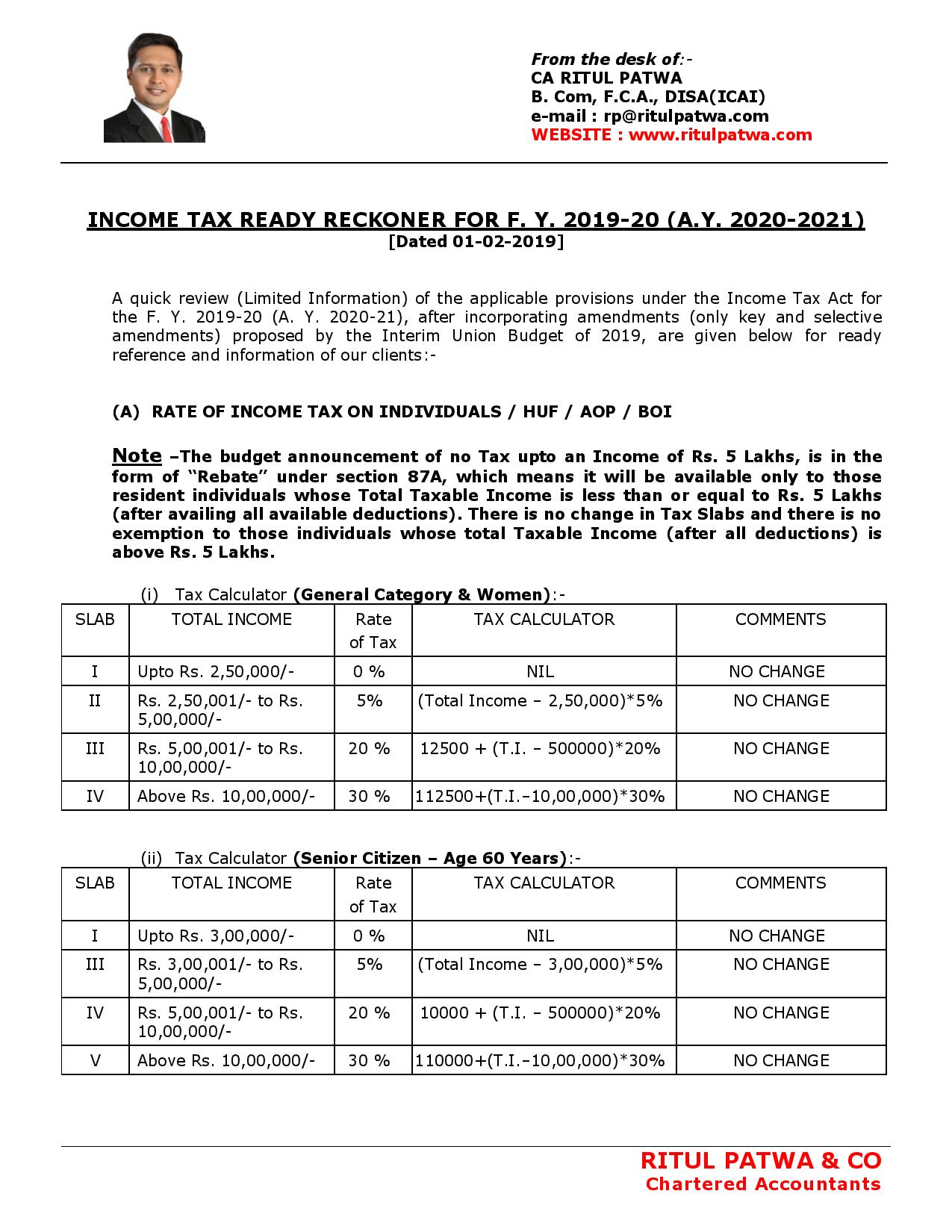

Income tax slabs for fy 2016 17 ay 2017 18. Know your india annual salary tax for the financial year 2017 2018. Domestic companies are taxed at the rate of 30 of total income. This indian income tax calculator fy 2017 18 helps you easily calculate your taxable income in just one click.

Hence the bill had proposed to defer the. 9 if the assessee is a unit located in an international financial services centre and derives its income solely in convertible foreign exchange. The tax rate is 15 with effect from ay 2020 21 fy 2019 20 2. 8 52 000 plus cess as applicable being higher than the mat liability.

This is a good move to align the exemption amount with today s rent and keep the section relevant. Income tax calculator for f y. Download automatic mat calculator in excel format xls version with case laws. 10 crore the minimum alternate tax cannot exceed the following.

1 crore but does not exceed rs. Tax computed at 15 previously 18 5 on book profit plus cess and surcharge. The amount of income tax shall be increased by a surcharge at the rate of 7 of such tax where total income exceeds one crore rupees but not exceeding ten crore rupees and at the rate of 12 of such tax where total income exceeds ten crore rupees. Income tax slab for fy 2015 16 ay 2016 17.

18 5 iakh book profit rs. However with effect from tax year 2017 2018 tax rate for domestic companies with turnover or gross receipt not exceeding rs. Thus the tax liability of sm energy pvt. 50 crore in the previous year 2015 16 are liable to pay tax at the rate of 25 instead of 30 proposed in budget 2017.

If book profit of a company exceeds rs. Minimum alternate tax mat. Income tax calculator for fy 2016 17 ay 2017 18. This means if your turnover for the financial year 2015 16 is less than or equal to 50 crore rupees then tax rate for the previous year 2017 18 will be 25.

Mat is equal to 18 5 15 from ay 2020 21 of book profits plus surcharge and cess as applicable. Income tax calculator india 2017 18.