Mat Calculation For Ay 2018 19

Rs 14 43 000 rs 12 48 000 rs 1 95 000.

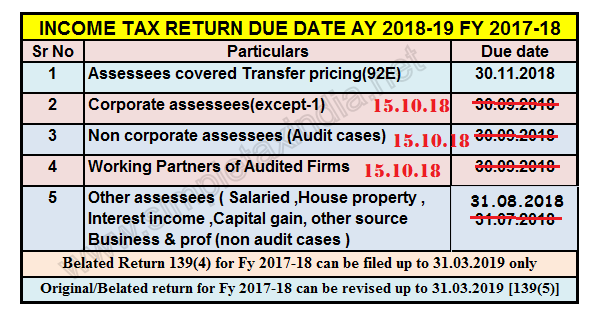

Mat calculation for ay 2018 19. Tax liability of a company for fy 2019 20 under normal provisions of the income tax act is rs. On minimum alternate tax mat alternate minimum tax amt a mat was introduced for the first time in the ay 1988 89. In this case it has been assumed that the turnover of company exceeds rs. 9a 9c for year 2018 19.

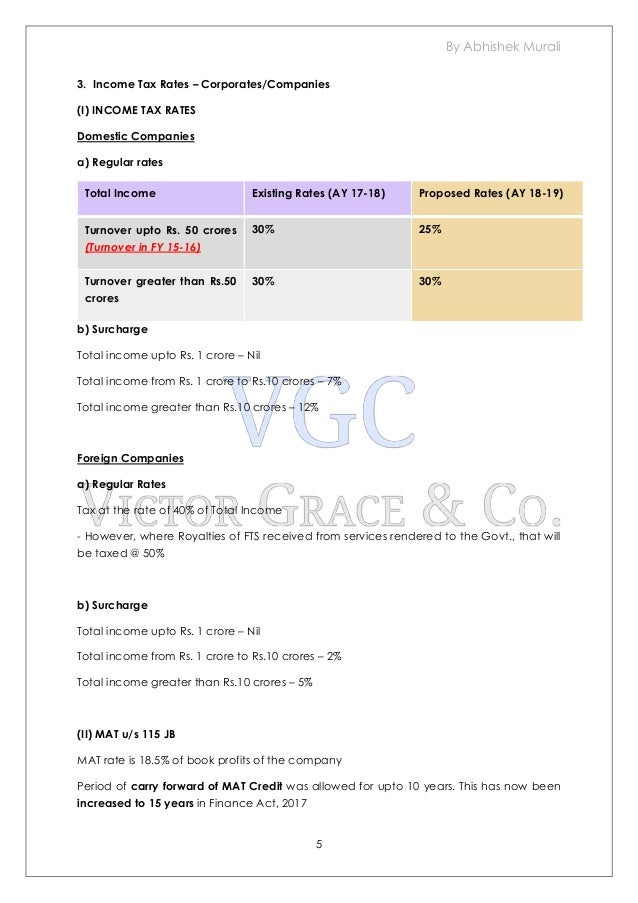

View all popular posts. Previously the mat credit was allowed to carry forward for a period of 10 years but from ay 2018 19 it can be carried forward for 15 assessment years. Mat credit is allowed to set off when tax is paid on the regular income under the provisions of income tax instead of mat. This is with effect from ay 2018 19 prior to which mat could be carried forward only for a period of 10 ays.

Income tax rate chart for ay 2019 20 and ay 2020 21. Friends most of us face the challenge of calculating tax as per income tax and as 22. Applicability and non applicability of mat. 400 in previous year 2018 19.

A domestic company is taxable at the rate of 25 if its turnover or gross receipt does not exceed rs. 400 crores in the previous year 2018 19. 8 lakh while the liability as per the provisions of mat. Such tax credit shall be carried forward for 15 assessment years immediately succeeding the assessment year in which such credit has become allowable.

Ans when the amount of minimum alternate tax mat for a company is greater than its normal tax liability the difference between mat and normal tax liability is called mat credit. Here an effort is made to comprise all tax computation viz provision for tax mat deferred tax and allowance and disallowance of depreciation under companies act and income tax act in one single excel file. Being higher than the mat liability. It was felt that due to various concession provided in tax laws big corporate groups become zero tax companies.

Minimum alternate tax mat rates for the a y.