Mat Calculation For Ay 2018 19 In Excel

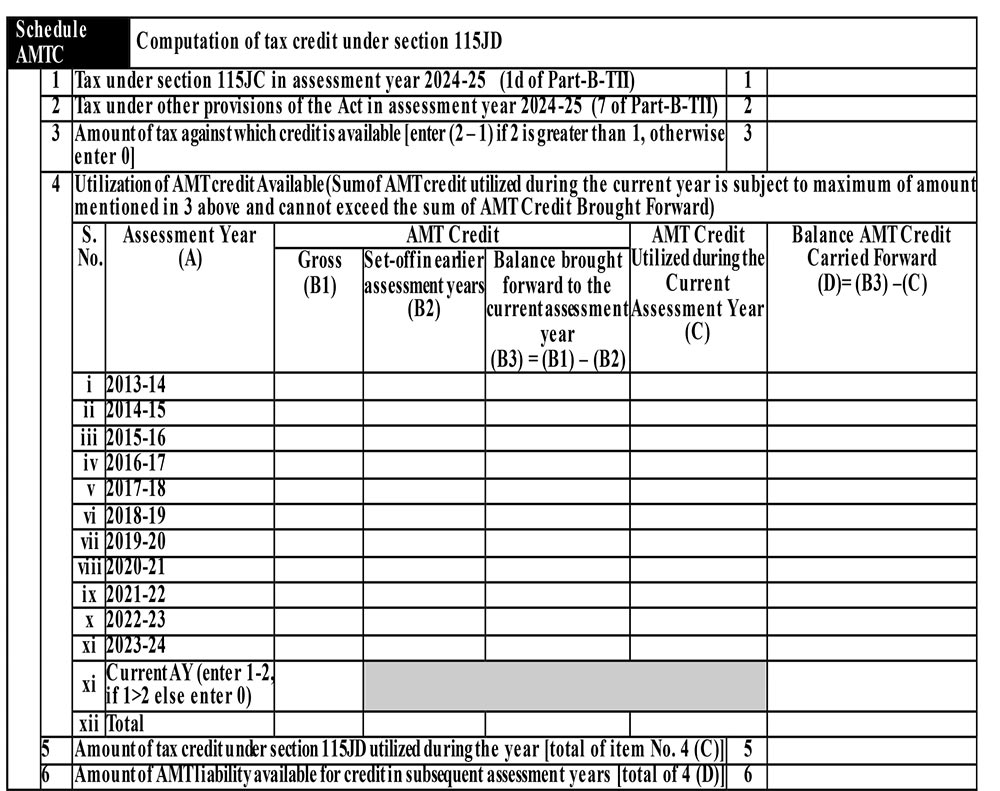

Mat and amt mat stands for minimum alternate tax and amt stands for alternate minimum tax.

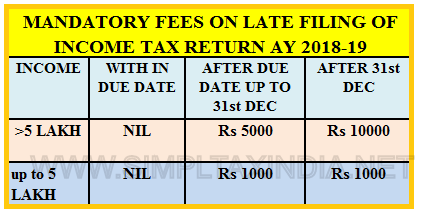

Mat calculation for ay 2018 19 in excel. 1 additional health cess taking total cess on income tax to 4 2 education cess 1 higher education cess continues. Standard deduction of rs 40 000 to salaried and pensioners. Mat working computation file. This will marginally increase income tax for every tax payer.

It computation sheet excel f y 2018 19 download preview. Initially the concept of mat was introduced for companies and progressively it has been made applicable to all other taxpayers in the form of amt. No change in income tax slabs 2. Basic excel tutorials and practice.

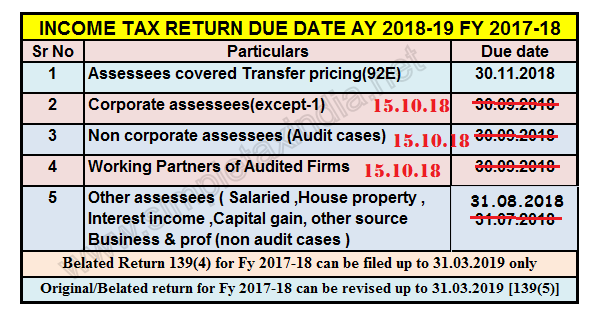

Tcs on collection u s 206c 1h with gst e invoice. It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant acts rules etc. Income tax computation sheet financial year 2018 19. Check out the concepts of mat how to calculate mat.

Know about mat minimum alternative tax which is tax payable under income tax act. We have attached below an excel utility to co. Income tax calculator fy 2018 19 ay 2019 20 is a simple tax estimator for indian taxpayers with calculations of gross incomes from multiple sources all allowed and possible deductions. Click here to view the full article.

Income tax computation sheet financial year 2018 19. Can i have the excel file which calculate deferred tax and mat unable to see. Tax computation on total income including arrear for fy 2018 19 is incorrect as it doesn t consider surcharge 10 if total income exceeds rs. Income tax computation sheet financial year 2018 19 xlsx.

Tax information and services tax services. Kindly update the calculator for the above mentioned imitations share the updated one. Other files by the user. In this part you can gain knowledge about various provisions relating to mat and amt.

Excel based income tax calculator for fy 2019 20 ay 2020 21 3. 2526 times file size. Changes in income tax rules.