Mat Calculation For Ay 2017 18

Ans when the amount of minimum alternate tax mat for a company is greater than its normal tax liability the difference between mat and normal tax liability is called mat credit.

Mat calculation for ay 2017 18. In the below income tax calculator india enter your net income gender and mode of tax payer and click calculate. A domestic company is taxable at the rate of 25 if its turnover or gross receipt does. 8 lakh while the liability as per the provisions of mat. 8 52 000 plus cess as applicable being higher than the mat liability.

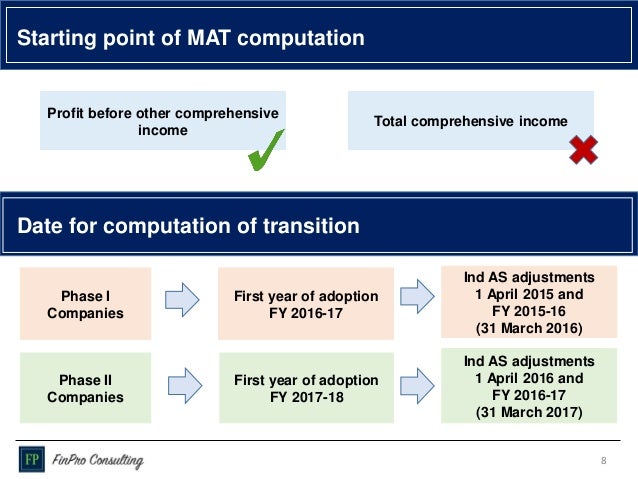

Mat is equal to 18 5 15 from ay 2020 21 of book profits plus surcharge and cess as applicable. Income tax payable shall be the higher of the following amounts. Know your india annual salary tax for the financial year 2017 2018. It was felt that due to various concession provided in tax laws big corporate groups become zero tax companies.

On minimum alternate tax mat alternate minimum tax amt a mat was introduced for the first time in the ay 1988 89. This indian income tax calculator fy 2017 18 helps you easily calculate your taxable income in just one click. 2017 18 13 33 850 15 75 900. Income tax calculator india 2017 18.

Income tax slab rates from ay 1992 93 to ay 2015 16 download income tax calculator for a y. For assessment year 2017 18 tax rate would be 29 where turnover or gross receipt of the company does not exceed rs. Thus the tax liability of sm energy pvt. 115jc 115jd 115jee 115jf rule 40ba form no.

The amount of income tax shall be increased by a surcharge at the rate of 7 of such tax where total income exceeds one crore rupees but not exceeding ten crore rupees and at the rate of 12 of such tax where total income exceeds ten crore rupees. Book profit means the net profit as shown in the profit loss account for the year as increased and decreased by the following items. Tax liability of a company for fy 2019 20 under normal provisions of the income tax act is rs. Minimum alternate tax mat rates for the a y.

2012 13 2011 12 2010 2011 tags. Before proceeding on how mat is calculated first provisions related to mat calculation is important to learn.