Mat Accounting Entries

Refer my article on the accounting entry for provision for income tax.

Mat accounting entries. Proper journal entry formal includes a date account name description of transaction as well as debit and credit columns. Journal entry format is the way journal entries are organized and appear in the general journal and other journals. Mat credit may be considered as a deferred tax asset for the purpose of accounting standard as 22 which relates to accounting for taxes on income. However when the mat credit is not considered as a deferred tax asset it is still to be considered as an asset and the same should be classified under the head loans and advances.

For accounting entries relating to reversal and utilization of mat credit click here. Hence tax payable by company 20 28 000. When the tax payable as per income tax provisions is higher. The following journal entry will be recognised in the separate accounting records of company b on 31 january 20 18.

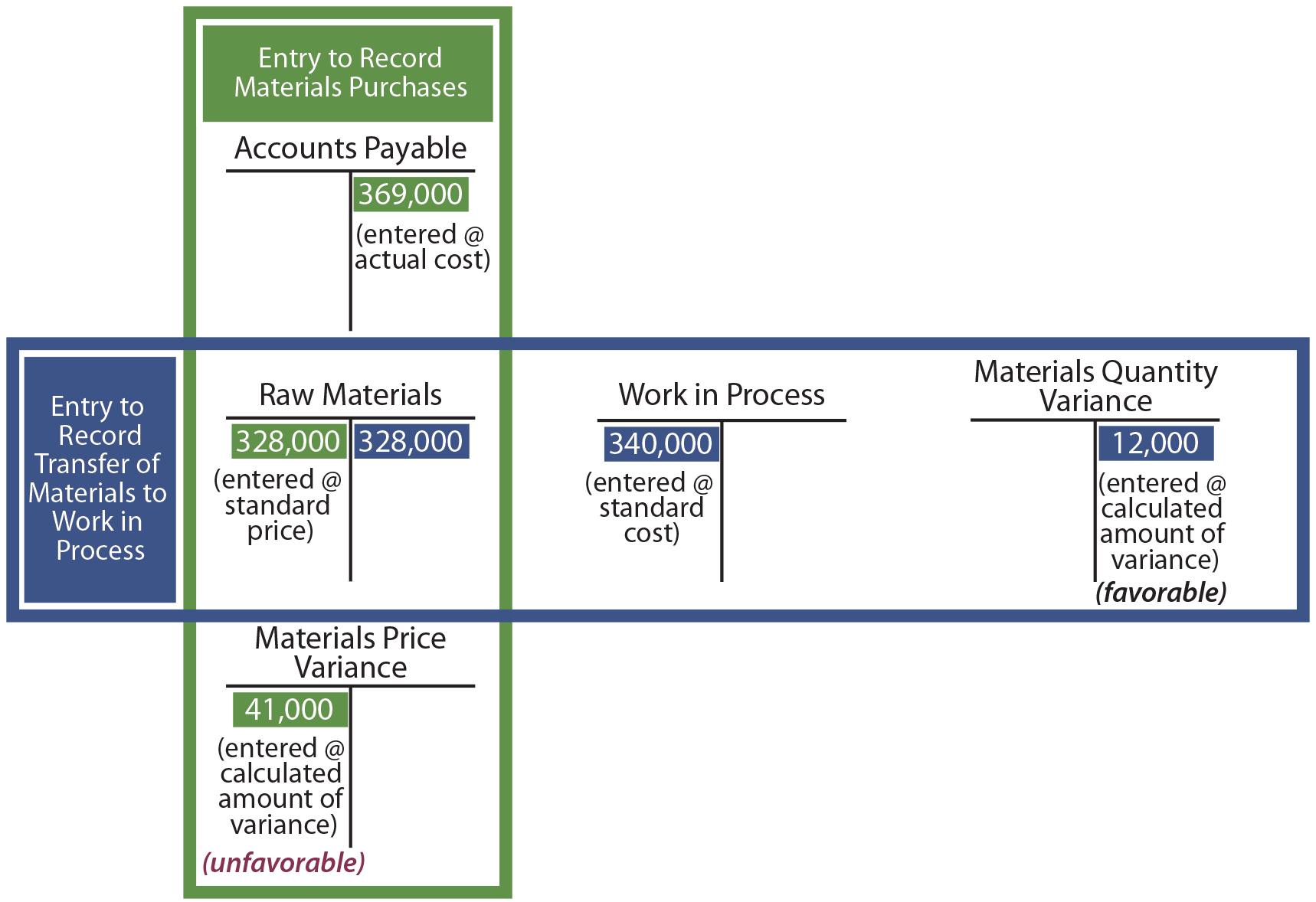

Investment in subsidiary sfp bank sfp recognising the investment in company s at cost. 1 700 000. 3 4 journal entries for the flow of production costs. It is not appropriate to consider mat credit as a deferred tax asset for the purposes of accounting standard 22 accounting for taxes on income although mat credit is not a deferred tax asset under as 22 but it can be considered as an asset and the same should be presented under the head loans and advances considering it is of the nature.

The journal entries for the flow of production costs are the same with process and job costing. The cost flow is as follows. The differences between taxable income and accounting income for a period that originate in one period and are capable of reversal in one or more subsequent periods. Lets assume that income tax is 100 mat is 120 you ll have to pay 120 and a credit of the difference between both the amounts will be granted to you.

Total tax payable under mat 19 50 000 78 800 20 28 000. In this case mat doesn t arise and hence accounting treatment is similar to the entry to be passed for provision for tax. Mat under p l a c dr 100 mat credit under lo.